This submit could comprise affiliate hyperlinks and Corporette® could earn commissions for purchases made by hyperlinks on this submit. As an Amazon Affiliate, I earn from qualifying purchases.

I’ve at all times been a fan of amortizing for sure bills by saving cash every month in a particular spot, aka a sinking fund. It has been some time since we mentioned this — readers, do you’ve sinking funds? What are your huge sinking fund classes?

Previously we have shared our cash roadmap (what to do first/subsequent in your private finance journey), the best way to automate your financial savings and the best way to arrange computerized investing, in addition to mentioned the best way to save for a number of monetary objectives. We have additionally talked about the place to maintain your emergency fund, and the place to stash your money while you’re not sure what you are saving for (e.g., retirement, marriage ceremony, home, and so on).

(A few of our extra particular discussions that I typically take into consideration together with surviving divorce, financially, in addition to the best way to repay huge scholar loans and different huge money owed. We have additionally shared monetary ideas for brand spanking new legal professionals and others of their first high-paying jobs!)

What’s a Sinking Fund?

A sinking fund is a approach of saving cash to spend it within the brief time period. It is designed to deal with giant however irregular bills. It differs from a daily financial savings account or emergency fund as a result of the cash is already earmarked to be spent.

Ought to You Make investments Your Sinking Fund?

Typically bills on your sinking fund needs to be on the close to horizon, so it in all probability would not make sense to take a position the cash into shares or index funds. Should you’re not fairly certain what you are saving for (marriage ceremony? home? grad college?) then I feel it makes extra sense to make investments that cash (routinely in case you can!).

I’d actually hesitate to make use of retirement financial savings for any of these functions, although, so I in all probability wouldn’t save them there except you’ve a Roth and your timeline is greater than 5 years away as a result of you possibly can at all times take the principal out of a Roth after it has been in it for 5 years.

Why Would You Want a Sinking Fund?

Much less Stress for Massive Payments / A Reward to Your Future Self

I’ve at all times been an enormous fan of sinking funds as a result of let’s face it, generally you get a big invoice and it feels type of painful, even whether it is considerably anticipated! For my husband and me, the one which began me on my journey in direction of sinking funds was our time period insurance coverage. We bought all of it arrange when our youngest son was born, after which I type of forgot about it… a yr later we bought the comparatively giant payments for each of us — and on the identical time as a result of we might arrange our time period insurance coverage insurance policies on the identical time.

That first invoice was fairly painful — partly as a result of we have been overinsured, which was simply adjusted down. (Now we’re each principally lined sufficient to pay the mortgage if one in all us dies.) However I nonetheless determined it was time to arrange an account to save lots of for this once-a-year set of payments.

At first, I simply totaled the premium quantities on the time period insurance coverage, then divided by 12 — muuuch extra doable. Then, as I began enthusiastic about it, I made a decision to complete all of our numerous insurance coverage premiums, and divided that new complete by 12. I arrange an computerized switch to a excessive yield financial savings account, and voila, my first sinking fund was created.

Good Curiosity Whereas You Wait

That is one other advantage of sinking funds – you possibly can set them up in a excessive yield financial savings account or perhaps a brief time period CD to get a greater rate of interest than you would possibly in case you saved the cash in your financial savings account.

That is in distinction to the excessive rates of interest you would possibly pay in case you put among the bills on bank cards, too.

Clear Delineations from Different Accounts

I suppose I might have simply taken the cash from our emergency fund, after which changed the cash with these computerized transfers I might arrange… however I am a type of individuals who actually hates touching the emergency fund.

On the flip facet, when the insurance coverage payments come, I’ve no qualms about utilizing our sinking fund for insurance coverage to pay the cash. Virtually each single time I do that, as a substitute of feeling responsible or like we’re residing past our means, I really feel relieved that I assumed to do that all these moons in the past. It is type of like a present to my future self.

My Sinking Fund Classes

As soon as you determine the logistics, it is very easy to arrange sinking funds, notably with excessive yield financial savings accounts the place it is simple to arrange completely different “buckets” and even completely completely different accounts. I’ve used Ally for years, however there are others on the market (and this submit shouldn’t be sponsored).

Different sinking fund classes that I’ve used over time:

- insurance coverage (basic)

- well being — I’ve at all times tried to place nonetheless a lot we expect we’d want for our deductible right into a financial savings account to make giant healthcare payments a bit extra palatable, and I lately began a month-to-month switch for our new well being financial savings account

- apartment/home initiatives — we have had huge quantities put aside and little quantities put aside. I generally, like now, wish to set a very small quantity apart each month ($20) regardless that we do not know what we’d spend it on… then after we out of the blue determine to switch tile or wallpaper the powder room or one thing like that, the cash put aside already makes me really feel higher about transferring ahead on the venture.

- Roth IRA — every month we put aside cash for my husband’s Roth IRA contribution (our accountant suggested in opposition to my having one)

- Trip funds — as a household of 4 holidays might be fairly costly, so I’ve tried to evaluate how a lot numerous sorts of holidays may cost a little for us, and the way typically we might need to go on them, after which arrange computerized transfers for every of these… as the cash grows it jogs my memory it is time to plan a trip. That is a type of conditions the place the delineation from different accounts actually helps me justify spending the cash.

- Costly child stuff — We do not at the moment have any sinking funds arrange for the children, however in years previous I’ve had them for 2 conditions. First, if the children had very costly courses ($700+) on a semi-regular foundation… or second, a big tuition expense that I most well-liked to unfold out over 12 months as a substitute of 9.

- (for the enterprise, I’ve sinking funds arrange for 1) taxes and my retirement — taxes I pay 3-5 occasions a yr for estimated taxes and generally further at tax time if the estimated taxes did not seize every little thing; for my retirement it is one huge contribution per yr and a couple of) persevering with schooling / contractors / authorized / accounting)

It is not fairly a sinking fund, however I do have a “Griffin Enjoyable Cash” fund that’s separate from the emergency fund

Tips on how to Set Up a Sinking Fund

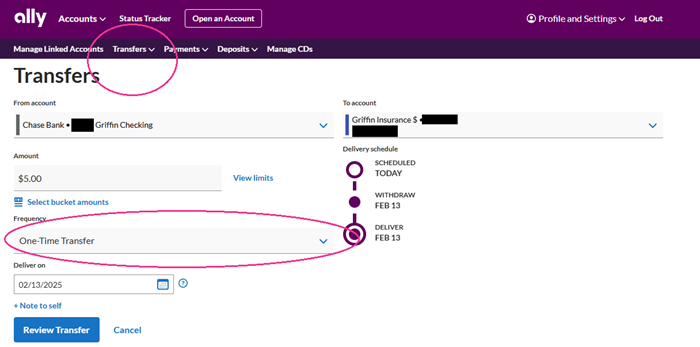

Every financial institution is a bit completely different, however you are going to search for a “Transfers” part — and there is nearly at all times a solution to set it up so it’s a repeating switch.

This is the way it appears to be like in Ally (for me, no less than) once I need to switch cash from Chase (the place we do our day by day banking) to an Ally account. Once I click on the Frequency dropdown menu, I’ve the choice to set the switch up regularly like biweekly, to decide on a selected day of the month, or to decide on a repeating day like first/final enterprise day of every month. You may also arrange an finish date to cease the transfers.

If in case you have a number of repeating transfers and automatic financial savings/investments, be sure to hold an inventory of what quantity is transferring and when!

Inventory picture through Pexels / maitree rimthong.