Throughout occasions of turbulence and uncertainty within the markets, many buyers flip to dividend-yielding shares. These are sometimes firms which have excessive free money flows and reward shareholders with a excessive dividend payout.

Benzinga readers can evaluate the newest analyst takes on their favourite shares by visiting Analyst Inventory Rankings web page. Merchants can type via Benzinga’s in depth database of analyst scores, together with by analyst accuracy.

Under are the scores of essentially the most correct analysts for 3 high-yielding shares within the communication companies sector.

Omnicom Group Inc. OMC

- Dividend Yield: 3.78%

- JP Morgan analyst David Karnovsky maintained an Obese ranking and lower the worth goal from $119 to $116 on Jan. 27, 2025. This analyst has an accuracy charge of 68%.

- Wells Fargo analyst Steven Cahall maintained an Equal-Weight ranking and slashed the worth goal from $110 to $99 on Dec. 10, 2024. This analyst has an accuracy charge of 64%.

- Current Information: Omnicom will publish its first quarter outcomes on Tuesday, April 15, after the New York Inventory Change shut of buying and selling.

- Benzinga Professional’s real-time newsfeed alerted to newest OMC information.

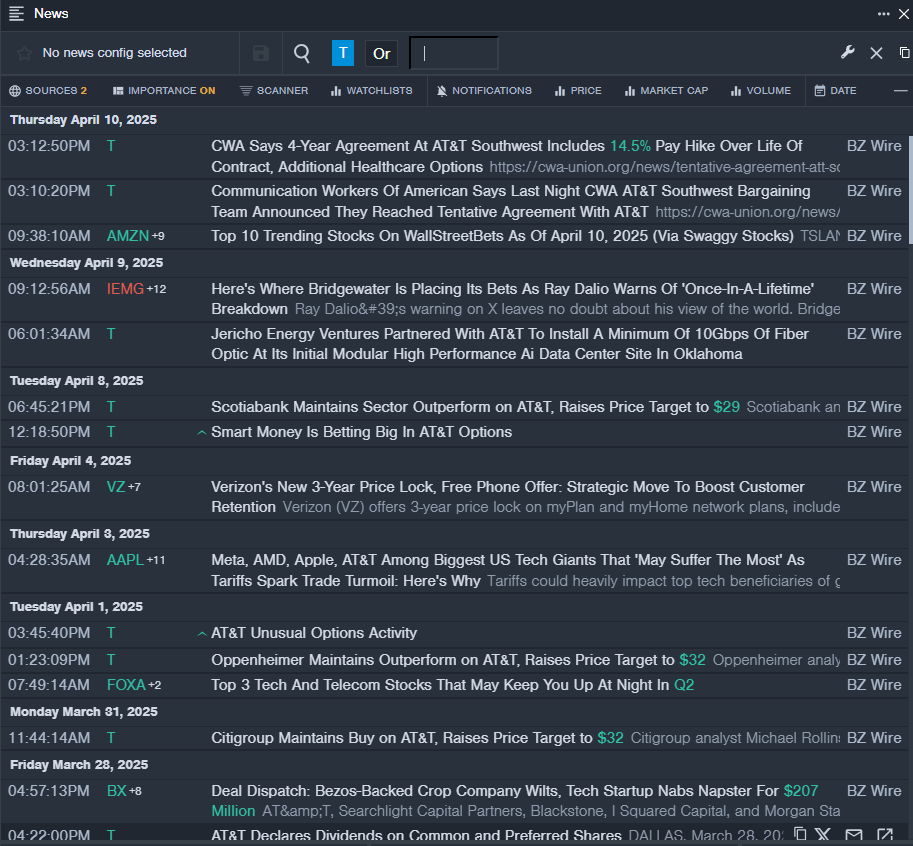

AT&T Inc. T

- Dividend Yield: 4.21%

- Oppenheimer analyst Timothy Horan maintained an Outperform ranking and raised the worth goal from $27 to $32 on April 1, 2025. This analyst has an accuracy charge of 72%.

- Citigroup analyst Michael Rollins maintained a Purchase ranking and raised the worth goal from $28 to $32 on March 31, 2025. This analyst has an accuracy charge of 78%.

- Current Information: BT Group has reportedly approached AT&T and Orange SA ORANY about potential partnerships.

- Benzinga Professional’s real-time newsfeed alerted to newest T information

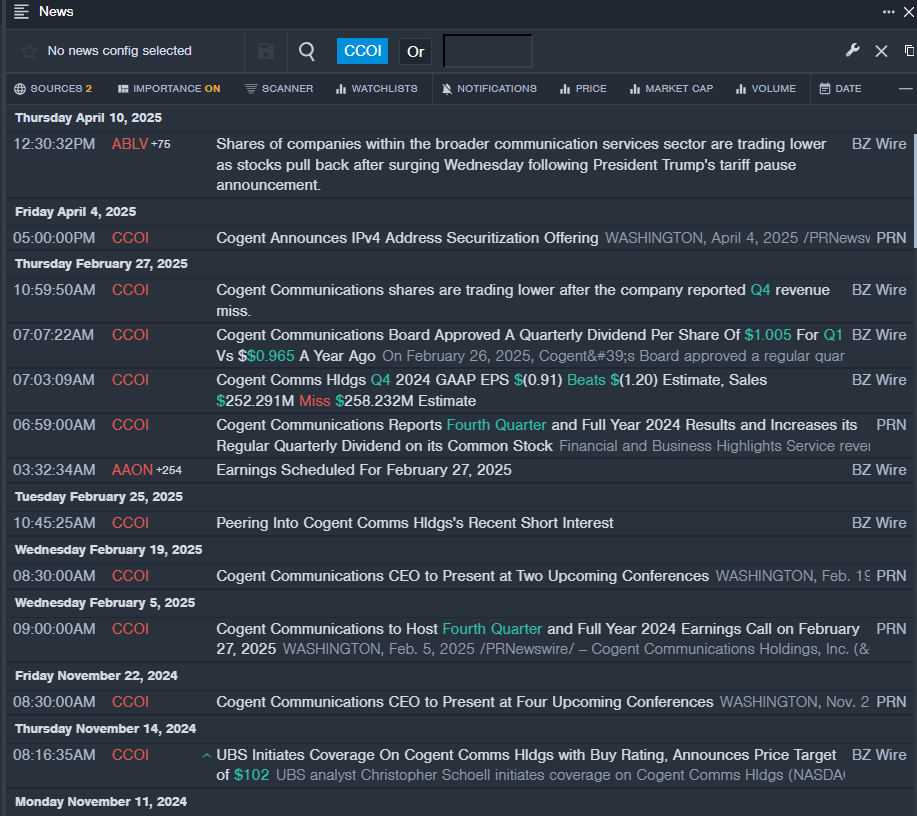

Cogent Communications Holdings, Inc. CCOI

- Dividend Yield: 7.94%

- UBS analyst Christopher Schoell initiated protection on the inventory with a Purchase ranking and a value goal of $102 on Nov. 14, 2024. This analyst has an accuracy charge of 62%.

- B of A Securities analyst David Barden downgraded the inventory from Impartial to Underperform and lower the worth goal from $75 to $65 on Aug. 21, 2024. This analyst has an accuracy charge of 71%.

- Current Information: On Feb. 27, Cogent Communications reported a fourth-quarter income miss.

- Benzinga Professional’s real-time newsfeed alerted to newest CCOI information

Learn Extra:

Picture by way of Shutterstock

Market Information and Information dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.