How the native inventory market fared in the present day: March 12, 2025

MANILA, Philippines – The native bourse ended within the purple on Wednesday, mirroring the Wall Road stoop as traders digested the impression of an escalating world commerce conflict.

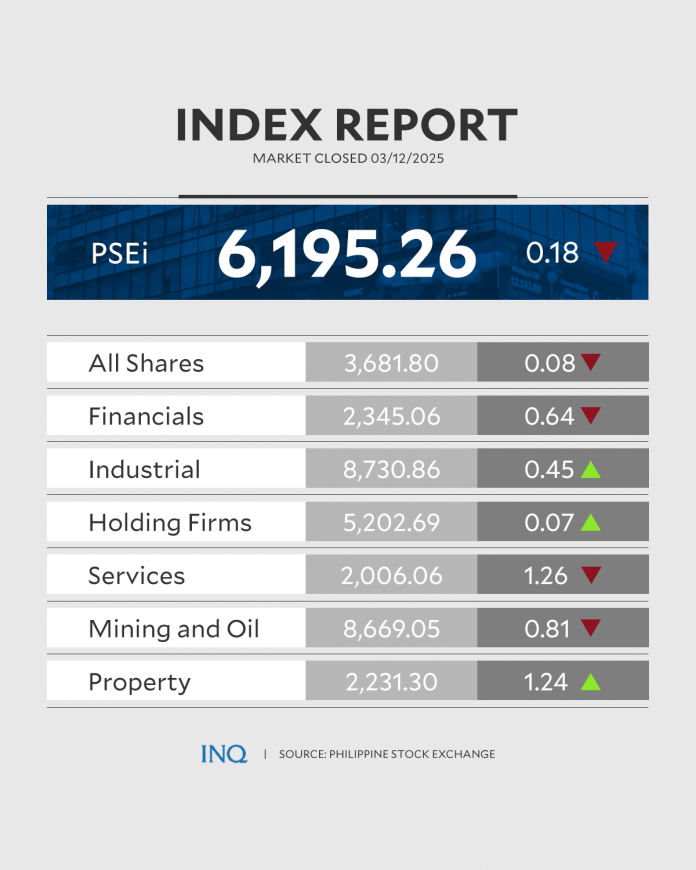

The benchmark Philippine Inventory Change Index (PSEi) slid by 0.18 %, or 11.29 factors, to shut at 6,195.26.

Though the PSEi slid to as little as 6,123.88 throughout the day, the decline on Wednesday was noticeably lower than its 2.18-percent fall the day prior to this, or when former President Rodrigo Duterte had been arrested on fees crimes towards humanity.

Likewise, the broader All Shares Index was practically flat because it misplaced 0.08 %, or 2.79 factors, to three,681.8.

A complete of 741.54 million shares value P5.98 billion modified arms as foreigners made web purchases value P2.62 million, inventory trade information confirmed.

Traders snapped up shares of property, industrial and holding companies whereas shedding banks, mining and providers firms.

Losers overpowered gainers, 127 to 77, whereas 40 firms closed unchanged.

Whereas Duterte’s arrest could have had a hand out there’s decline, Trump’s tariff insurance policies have been nonetheless the primary wrongdoer, mentioned Japhet Tantiangco, analysis head at Philstocks Monetary Inc.

READ: Inventory markets prolong losses over US tariffs, recession fears

“Traders additionally digested the US’ 25-percent tariffs on metal and aluminum imports, which had already taken impact, and the following retaliation from the European Union,” Tantiangco mentioned.

Asian equities principally fell Wednesday on issues about President Donald Trump’s risky commerce coverage pronouncements.

READ: Most Asian shares drop as Trump commerce coverage sows uncertainty