[Updated on January 28, 2025 with screenshots from TurboTax Deluxe download software for the 2024 tax year.]

A Mega Backdoor Roth means making non-Roth after-tax contributions to a 401k-type plan after which transferring it to the Roth account throughout the plan or taking the cash out (with earnings) to a Roth IRA. Should you’re in search of the common backdoor Roth, the place you contribute to a Conventional IRA (not a 401k-type plan) earlier than changing it to Roth, please see How To Report Backdoor Roth In TurboTax (Up to date).

A mega backdoor Roth is an effective way to place further cash right into a Roth account with out having to pay a lot further tax. Not all employer plans enable non-Roth after-tax contributions however some estimated that 40% of individuals can do it.

Suppose your employer plan permits it and also you executed a Mega Backdoor Roth. You’ll obtain a 1099-R from the plan within the following yr. You’ll need to account for it in your tax return. Right here’s the best way to do it in TurboTax.

Use Downloaded Software program

It is best to do it in TurboTax Deluxe downloaded software program. The downloaded software program is each cheaper and extra highly effective than on-line software program. Should you haven’t paid in your TurboTax On-line submitting but, you should buy TurboTax from Amazon or Costco and change from TurboTax On-line to TurboTax obtain (see directions for the best way to make the change from TurboTax).

Should you use different tax software program, please see:

Throughout the Plan Or To Roth IRA

You are able to do the Mega Backdoor Roth in two methods — convert throughout the plan or withdraw to a Roth IRA. Changing throughout the plan is way simpler, and plenty of plans automate this course of. Transferring to a Roth IRA additionally works. See the earlier publish Mega Backdoor Roth: Convert Inside Plan or Out to Roth IRA?

Right here’s the state of affairs we’ll use for instance:

You contributed $10,000 as non-Roth after-tax contributions to your 401(okay). By the point the cash was transformed to the Roth account throughout the plan or transferred to your Roth IRA, your contributions earned $200. You transformed $10,200 to your Roth account.

I’m utilizing 401(okay) as a shorthand. It really works the identical in a 403(b).

Break up Rollover

Should you did a break up rollover — after-tax contributions to a Roth IRA and the earnings to a Conventional IRA — and the plan administrator issued one 1099-R in your two rollovers, you’ll want to separate your 1099-R and enter two 1099-R types in TurboTax. See One 1099-R Kind for Two Rollovers in TurboTax and H&R Block.

Should you imported the one 1099-R that covers each rollovers, delete it and manually enter two 1099-R types. The primary 1099-R reveals rolling over the after-tax contributions to a Roth IRA, for instance:

| Field 1 Gross Distribution | $10,000 |

| Field 2a Taxable Quantity | $0 |

| Field 2b Taxable quantity not decided | not checked |

| Field 5 Worker contributions/Designated Roth contributions or insurance coverage premiums |

$10,000 |

| Field 7 Distribution code(s) | G |

| Field 7 IRA/SEP/SIMPLE checkbox | not checked |

The second 1099-R reveals rolling over the earnings to a Conventional IRA, for instance:

| Field 1 Gross Distribution | $200 |

| Field 2a Taxable Quantity | $0 |

| Field 2b Taxable quantity not decided | not checked |

| Field 5 Worker contributions/Designated Roth contributions or insurance coverage premiums |

$0 |

| Field 7 Distribution code(s) | G |

| Field 7 IRA/SEP/SIMPLE checkbox | not checked |

The remainder of this publish reveals what to do with the primary 1099-R (after-tax to Roth IRA). The second 1099-R (earnings to Conventional IRA) is a straight Conventional-to-Conventional rollover.

1099-R Entries

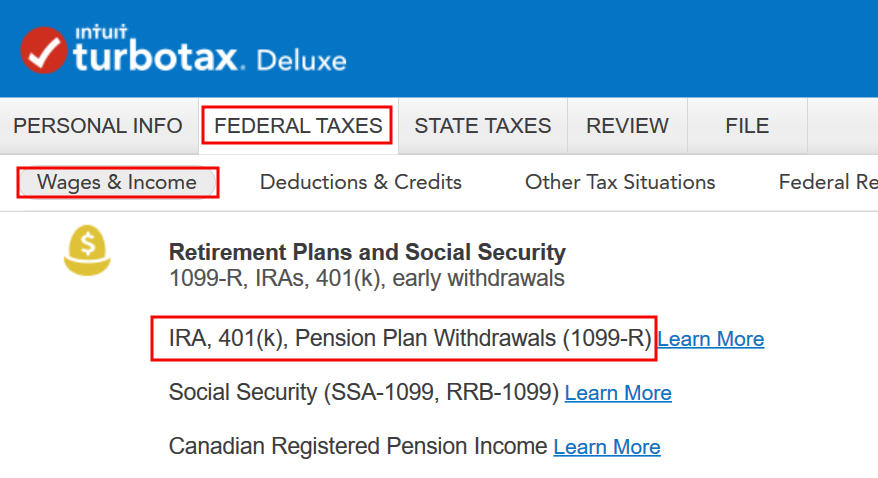

Go to Federal Taxes -> Wages & Earnings -> IRA, 401(okay), Pension Plan Withdrawals (1099-R).

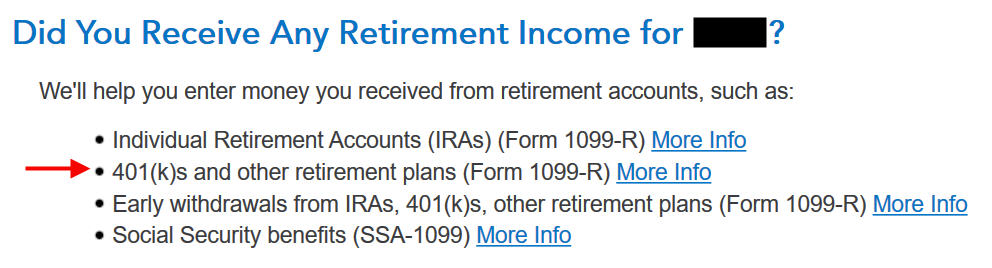

While you come to the Retirement Earnings part, reply Sure since you acquired a 1099-R out of your 401(okay) plan.

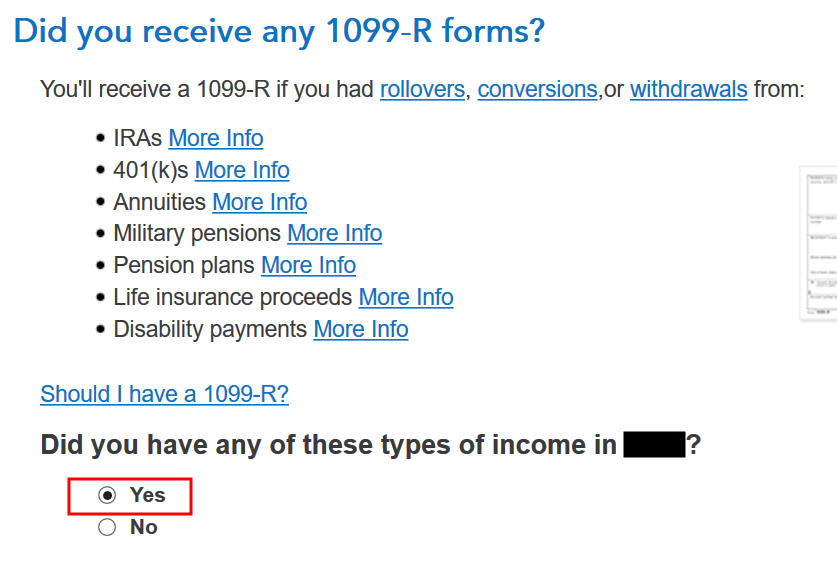

Sure, you acquired a 1099-R kind. Import the 1099-R if you happen to’d like. I’m typing it myself right here.

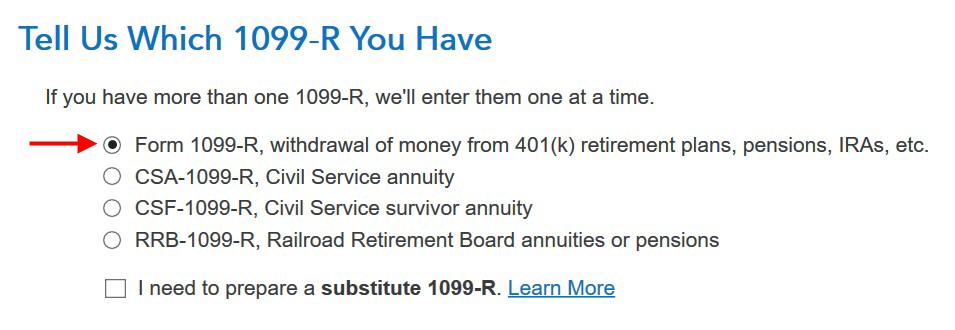

You have got a traditional 1099-R.

Should you import the 1099-R, verify the import rigorously to verify it matches your copy precisely. Should you sort the 1099-R, you should definitely sort it precisely.

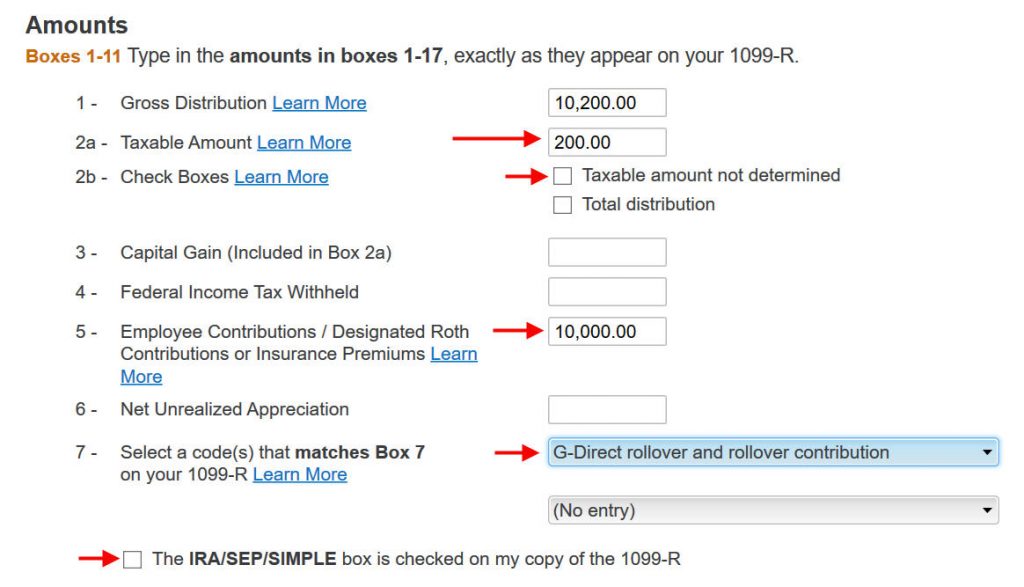

The earnings portion ought to be in Field 2a. Field 2b “Taxable quantity not decided” ought to NOT be checked. The non-Roth after-tax contributions (the “principal”) ought to be in Field 5. Field 7 ought to present a code G. Lastly, the field “The IRA/SEP/SIMPLE field is checked on my copy of the 1099-R” ought to NOT be checked.

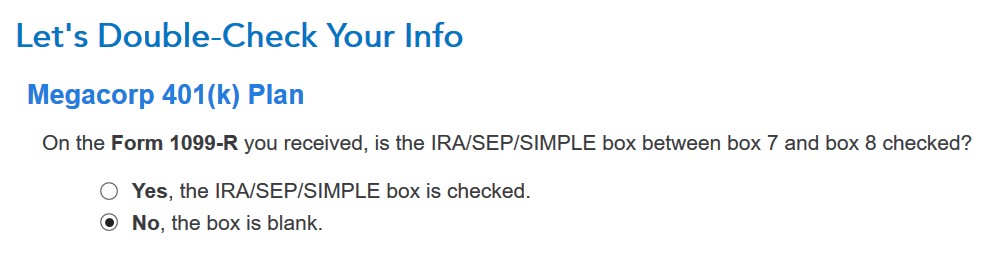

TurboTax needs to verify the IRA/SEP/SIMPLE checkbox isn’t checked.

Rollover Vacation spot

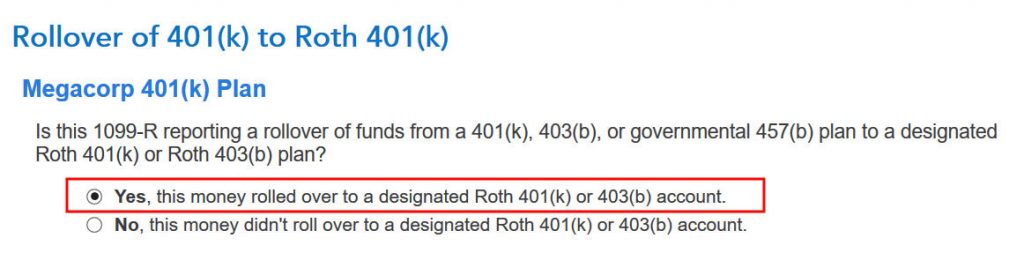

Should you transformed to Roth throughout the plan, reply Sure right here. Should you took the cash out of the plan to a Roth IRA, reply No.

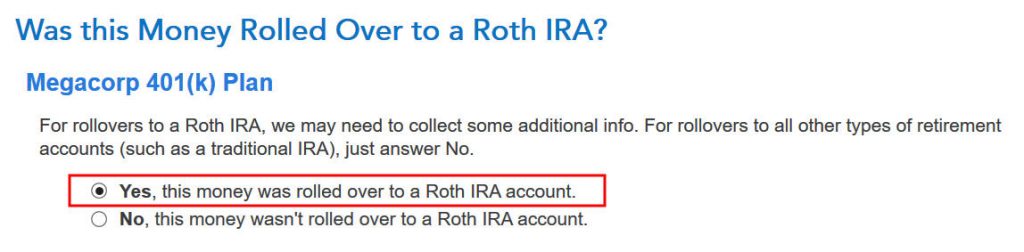

Should you answered “No” to the earlier query, affirm that the cash went to a Roth IRA.

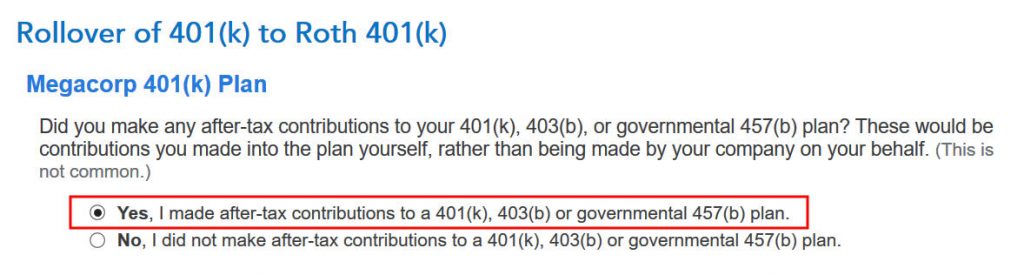

After-Tax Contributions

Reply Sure to verify that you just made non-Roth after-tax contributions to your plan.

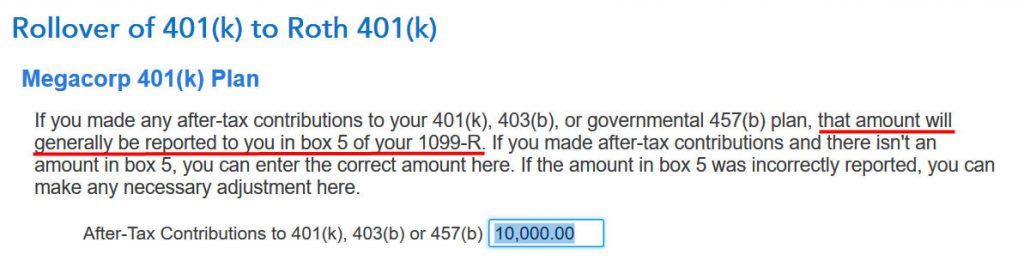

TurboTax pulls up the quantity of your non-Roth after-tax contributions from Field 5 of your 1099-R. In case your 1099-R isn’t right, it’s best to work along with your 401(okay) administrator to have it corrected.

Not a public security officer, except you really are.

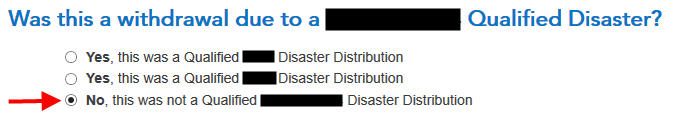

It wasn’t attributable to a catastrophe.

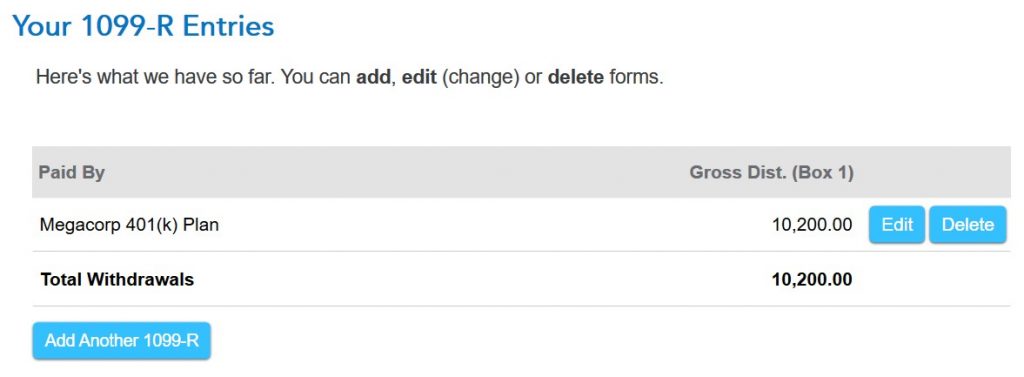

The abstract reveals your 1099-R entries. Repeat and add any further 1099-Rs you will have.

Confirm on Kind 1040

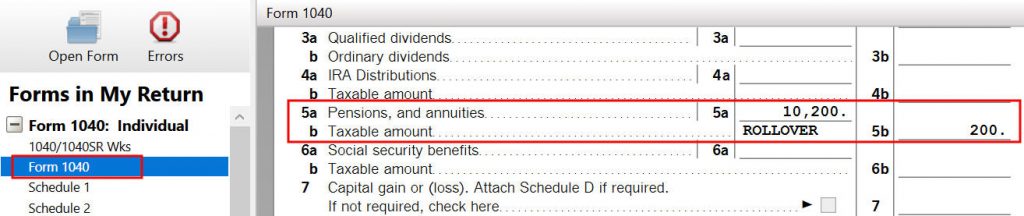

Now let’s affirm you’re solely paying tax on the $200 earnings, not in your $10,000 non-Roth after-tax contributions.

Click on on Kinds on the highest proper.

Discover “Kind 1040” within the left navigation pane. Scroll up or down in the best pane to traces 5a and 5b. Line 5a consists of the $10,200 gross distribution quantity. Line 5b solely consists of the $200 taxable quantity.

With a Mega Backdoor Roth, you place an additional $10k into your Roth account. After paying tax on this $200, the long run earnings on the $10,200 might be tax-free.

While you’re achieved inspecting the shape, click on on Step-by-Step on the highest proper to get again to the interview.

Say No To Administration Charges

If you’re paying an advisor a share of your property, you’re paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.