FreeTaxUSA Tax Preparation

Product Title: FreeTaxUSA Tax Preparation

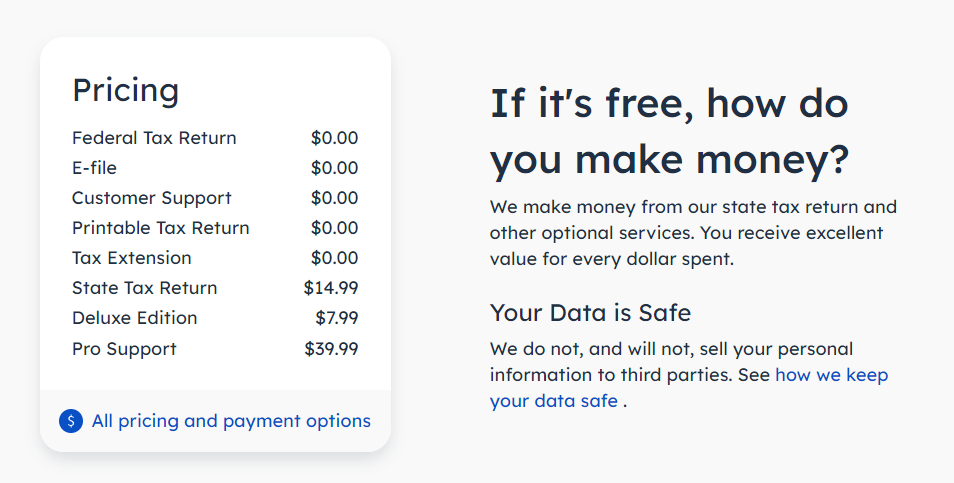

Product Description: FreeTaxUSA is a free tax federal preparation software program package deal that anybody can use, no matter earnings or tax scenario. Federal returns are all the time free. State filings are $14.99 and you’ll pay further for assist and different providers, like audit safety.

Abstract

FreeTaxUSA affords free federal returns for nearly all tax conditions, and state returns are $14.99 every. You may add on tax help for $39.99 and audit protection for less than $19.99. If you happen to don’t qualify for different tax software program’s free variations, you possible received’t discover cheaper tax submitting anyplace else.

Execs

- Free federal returns

- Low-cost state returns

- Entry to a tax professional

- Audit protection accessible

Cons

- Not fully free (state returns are $14.99)

- Restricted customer support hours

- Knowledge importing limitations

FreeTaxUSA is a tax preparation software program program that’s precisely what the identify implies – free.

It’s free to file your federal earnings tax return and $14.99 per state return.

With FreeTaxUSA, you may put together your tax returns without cost, even when they’re extra difficult. Most tax prep software program applications solely will let you file without cost underneath sure very restricted situations. That’s not the case with FreeTaxUSA, and that’s why this software program is effectively price a detailed look.

At a Look

- Nearly all tax conditions are lined.

- Federal returns are free, state returns are $14.99

- Tax help could be added for $39.99

- Audit protection could be added for $19.99

Who Ought to Use FreeTaxUSA

If you happen to don’t qualify for a free model at a competitor, then you must think about FreeTaxUSA. The service is cheap and straightforward to make use of. The add-on options, similar to tax help and audit protection, are additionally fairly priced so you must be capable to get all of your tax wants met.

Nevertheless, in the event you qualify for a completely free model, similar to TurboTax’s free model, that doesn’t cost a payment to your state return, it can save you some cash through the use of that as an alternative.

FreeTaxUSA Options

Desk of Contents

FreeTaxUSA Free Model

The Free Model permits without cost federal returns and covers mainly all tax conditions, which may be very uncommon for a free plan. State returns aren’t free, however they’re cheap, simply $14.99 per state.

That is significantly cheaper than how a lot it prices to get taxes professionally ready. Accountants will cost $263-$368 to organize a Type 1040.

As soon as once more, one of many main benefits of utilizing FreeTaxUSA is that it helps nearly any sort of earnings tax return. That’s a really uncommon advantage of utilizing this program.

For the free model, buyer assist is out there by electronic mail, however not by reside chat.

Returns are saved in PDF format. There’s no restrict on what number of returns you may retailer, and no cost for doing so. You can too obtain and both retailer or print your returns by yourself pc.

FreeTaxUSA Deluxe Model

The FreeTaxUSA Deluxe Model has the entire performance of the free model, however it provides a number of essential premium options which might be effectively definitely worth the worth. The paid model prices $7.99 to your federal earnings tax return and $14.99 for every state return filed.

These added options embody:

Limitless amendments. You may file amended federal earnings tax returns without cost once you filed utilizing the Deluxe model.

Precedence Help. This characteristic lets you get a precedence in your inquiries. That implies that your electronic mail or chat questions can be moved to the entrance of the road. That may put you forward of customers who’re working solely with the free model.

Stay Chat. If in case you have questions concerning the software program you may chat with customer support in actual time. This doesn’t embody tax questions.

Add-ons

There are a couple of extra providers you may add on if you want.

Professional Help. If in case you have tax questions which might be particular to your scenario, you may converse to a tax skilled for $39.99. You’ll be capable to share your display screen with them and so they can stroll you thru any questions you’ve gotten.

Audit Protection. For simply $19.99 you will get audit protection. If you’re audited, FreeTaxUSA will talk with the IRS in your behalf and supply as much as $1 million in providers. They may provide help to with each federal and state audits.

FreeTaxUSA affords most of the options and advantages that you simply usually discover with paid tax software program applications or those who cost a lot larger charges.

FreeTaxUSA accommodates submitting extra difficult returns. This contains self-employed taxpayers, rental earnings, Okay-1 earnings from an LLC, partnership, or S company, or a house workplace deduction. You are able to do any and all of those with FreeTaxUSA, even with the free model.

FreeTaxUSA Refund Maximizer. This software double-checks your work on a return filed with one other tax prep software program program. You enter the knowledge from that return, and the maximizer will analyze it to find out in the event you might have gotten a much bigger refund with FreeTaxUSA.

Additionally, you may import prior yr’s tax returns from different software program.

Add W-2 from a PDF. If in case you have a PDF of your W-2 you may add it. This protects time and limits typos.

Pay charges together with your tax refund. If you need, you may pay the payment together with your tax return as an alternative of with a bank card. Nevertheless, this prices an additional $24.99 on high of the traditional payment. There’s no added value in the event you pay with a bank card. If in case you have a card, I might advocate utilizing it as an alternative.

Printed return: You’re going to get a PDF copy of your return that you could print without cost. Nevertheless, in the event you’d quite have FreeTaxUSA print it, they are going to mail you a paper copy of your return for $7.97, transport included. You can too get a replica that’s professionally certain for $15.97.

Accuracy Checker. FreeTaxUSA makes use of a real-time accuracy Checker to test your work all through the preparation course of. If this system determines that you might have made a mistake or an omission, you’ll be alerted. This may assist to maintain you on monitor all through the method.

Accuracy assure. FreeTaxUSA ensures the accuracy of your return as filed. You’ll be reimbursed for IRS-imposed penalties and curiosity for any errors, omissions or different misinformation ensuing from this system software program. (Penalties and curiosity on state earnings tax returns is not lined underneath this assure.)

Buyer assist. E-mail technical assist, included with all providers, is 8:00 AM – 11:00 PM Jap Commonplace Time on daily basis (together with weekends). They report answering most emails in underneath 20 minutes. Notably complicated questions would possibly take as much as 24 hours.

Prior years. If it’s essential to file taxes for prior years, you may file your federal returns without cost and $17.99 for every state.

Limitless amendments. You buy a package deal that permits for limitless amendments for simply $15.98. If you happen to filed utilizing the Deluxe plan, amendments are free.

FreeTaxUSA Options

Money App Taxes

Money App Taxes is a completely free solution to do your taxes. It completes each federal and state returns without cost and covers virtually all tax conditions. Audit protection is included, however there isn’t any choice to talk to a tax skilled, even for a payment.

You can also’t file a number of state returns, so in the event you earned earnings in a couple of state, you received’t be capable to use Money App Taxes.

Right here’s our full evaluate of Money App Taxes.

TurboTax

If you happen to qualify for TurboTax‘s free plan, you may file each your federal and one state return without cost. Nevertheless, solely easy returns qualify. You might be restricted to W-2 earnings, unemployment earnings, and a restricted quantity of curiosity earnings. You additionally should declare the usual deduction, however may declare the earned earnings tax credit score and baby tax credit.

If you happen to don’t qualify for the free plan, then you definately’ll pay as much as $89 for the federal return and $39 per state. You even have the choice so as to add on reside help from a tax skilled. You can too select to get your total return finished for you with their Full Service plan.

Right here’s our full evaluate of TurboTax.

TaxSlayer

TaxSlayer is one other software program that gives a totally free model. You may file each your federal and one state return without cost in the event you qualify.

To qualify, you’ll have to have underneath $100,000 in taxable earnings. You can also solely have W-2, unemployment earnings, and restricted curiosity earnings. You will need to take the usual deduction and can’t declare any dependents. You may deduct pupil mortgage curiosity and schooling bills.

If you happen to don’t qualify for the free model, you’ll possible qualify for the Basic model, which prices $22.95 for federal and $39.95 for every state return.

Right here’s our full evaluate of TaxSlayer.

Will FreeTaxUSA Work for You?

Regardless of a couple of program limitations, FreeTaxUSA is effectively price utilizing. It has far larger performance than many different free tax preparation software program applications, and even the Deluxe model prices only a fraction of what it does with different widespread paid applications.

Because of the lack of importing functionality, you have to anticipate to spend extra preparation time with this program then you’ll with TurboTax, however additionally, you will be saving a substantial amount of cash on this system payment.

The flexibility of FreeTaxUSA to accommodate even essentially the most difficult tax returns is nearly a built-in benefit. Most competing free tax software program applications can solely do essentially the most fundamental returns. If in case you have something extra difficult, you’ll have to maneuver as much as a premium model.

Even the favored paid applications use a graduated service stage. For instance, it’s possible you’ll pay $50 for a program that does fundamental returns, however then be required to pay $100 in the event you function a small enterprise. There are not any such up-charges with FreeTaxUSA.

If you need extra info, or if you wish to join this system, try the FreeTaxUSA web site.