Considered one of my shoppers lately requested, after Finances 2025, whether or not Rental Revenue as much as Rs.20 lakh is tax-free. The reply is YES however with a variety of IFs and BUTs.

In case you’re a property proprietor and earn rental revenue, there’s excellent news for you! The brand new guidelines within the 2025 Union Finances can help you legally cut back the tax it’s good to pay on rental revenue, serving to you retain extra of your earnings. On this weblog submit, we’ll break down how one can legally take pleasure in tax-free rental revenue of as much as ?20,00,000.

What’s Tax-Free Rental Revenue?

Tax-free rental revenue merely implies that you don’t must pay taxes on the revenue you make from renting out your property, as much as a sure restrict. That is potential by utilizing sure deductions and exemptions accessible within the tax legal guidelines.

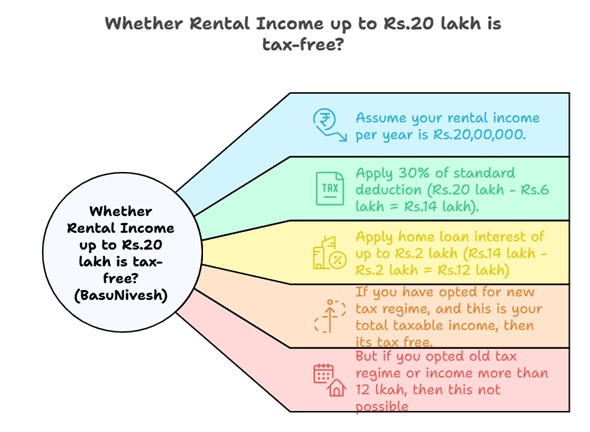

Whether or not Rental Revenue as much as Rs.20 lakh is tax-free?

To make rental revenue tax-free, there are particular deductions you possibly can benefit from. By correctly making use of these deductions, you possibly can considerably decrease your taxable rental revenue, doubtlessly to a degree the place no taxes are owed in any respect. Right here’s how you are able to do that:

1. Understanding the ?12,00,000 Threshold

First, it’s good to perceive the fundamental tax limits. Underneath the brand new finances guidelines, rental revenue of as much as ?12,00,000 per yr might be made tax-free with the best exemptions and deductions. In case your whole revenue, together with rental revenue, stays beneath ?12,00,000, you gained’t must pay any taxes.

2. Key Deductions Accessible to You

There are two main deductions you should use to cut back your rental revenue, each of that are utterly authorized and acknowledged by the tax authorities:

a. 30% Commonplace Deduction on Rental Revenue

The federal government presents a flat 30% deduction in your rental revenue. Which means that for any revenue you make from renting out your property, you’re routinely allowed to deduct 30% of it. This deduction is for upkeep, repairs, and different bills that include renting out a property.

For instance:

- In case you earn ?10,00,000 in rental revenue, you possibly can deduct ?3,00,000 (30% of ?10,00,000).

- This leaves you with ?7,00,000 as taxable revenue.

b. House Mortgage Curiosity Deduction

When you’ve got taken a mortgage to purchase the property you’re renting out, you possibly can deduct the curiosity paid on that dwelling mortgage out of your rental revenue. For properties which can be set free, the utmost you possibly can deduct is ?2,00,000 per yr. That is relevant to the brand new regime.

For instance:

- In case you’ve paid ?3,00,000 as curiosity on your property mortgage for the rented property in a yr, you possibly can declare a deduction of as much as ?2,00,000.

- This may additional cut back your taxable rental revenue.

3. Placing It All Collectively

Let’s say you earn ?20,00,000 from renting out your property in a yr. Right here’s how one can apply these deductions:

- Begin with ?20,00,000 in rental revenue.

- Apply the 30% commonplace deduction: ?20,00,000 – ?6,00,000 (30% of ?20,00,000) = ?14,00,000.

- Subsequent, for those who’ve paid ?2,00,000 as dwelling mortgage curiosity, you possibly can deduct that too: ?14,00,000 – ?2,00,000 = ?12,00,000.

Now, you’ve introduced down your taxable rental revenue to ?12,00,000. Since you’re throughout the ?12,00,000 restrict, you don’t have to pay any tax on this rental revenue!

4. What Occurs If Your Rental Revenue Exceeds ?12,00,000?

In case your rental revenue exceeds ?12,00,000 in spite of everything deductions, then the surplus quantity might be taxed in accordance with the revenue tax slab charges. For instance, for those who earn ?15,00,000 and after deductions, your taxable rental revenue is ?13,00,000, you’ll must pay tax on ?13,00,000. Nevertheless, you’ll nonetheless profit from the deductions and exemptions.

Why Is This Essential?

By understanding and making use of these deductions, it can save you a major sum of money on taxes. Particularly for individuals with a number of rental properties, these exemptions can add up rapidly, guaranteeing that your rental revenue just isn’t taxed on the full fee. The flexibility to cut back taxable revenue to ?12,00,000 means you could possibly doubtlessly make ?20,00,000 or extra in rental revenue with out having to pay taxes!

Ultimate Ideas

In conclusion, reaching a tax-free rental revenue of ?20,00,000 is feasible for those who benefit from the deductions accessible to you. The 30% commonplace deduction and residential mortgage curiosity deduction are two glorious methods to decrease your taxable rental revenue and doubtlessly maintain all of it tax-free. Simply keep in mind, in case your rental revenue goes above ?12,00,000, you’ll nonetheless must pay taxes on the surplus, however these deductions can considerably cut back the tax burden.

So, for those who’re renting out property, be certain to discover these deductions and seek the advice of a tax skilled to make sure you’re making essentially the most out of your rental revenue!

Nevertheless, you observed that that is potential solely when you have opted for a brand new tax regime and in case your whole taxable revenue from all sources (revenue from wage, revenue from home property, or revenue from different sources) collectively is effectively beneath or equal to ?12,00,000.