All through the final three months, 5 analysts have evaluated Seadrill SDRL, providing a various set of opinions from bullish to bearish.

The desk under supplies a snapshot of their latest scores, showcasing how sentiments have advanced over the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Complete Rankings | 5 | 0 | 0 | 0 | 0 |

| Final 30D | 1 | 0 | 0 | 0 | 0 |

| 1M In the past | 1 | 0 | 0 | 0 | 0 |

| 2M In the past | 2 | 0 | 0 | 0 | 0 |

| 3M In the past | 1 | 0 | 0 | 0 | 0 |

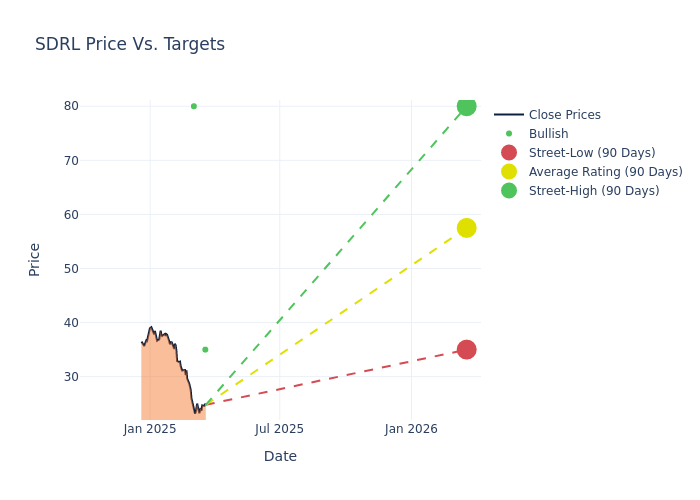

Analysts have lately evaluated Seadrill and supplied 12-month value targets. The typical goal is $64.2, accompanied by a excessive estimate of $80.00 and a low estimate of $35.00. A decline of 4.46% from the prior common value goal is obvious within the present common.

Investigating Analyst Rankings: An Elaborate Research

In inspecting latest analyst actions, we acquire insights into how monetary consultants understand Seadrill. The next abstract outlines key analysts, their latest evaluations, and changes to scores and value targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Value Goal | Prior Value Goal |

|---|---|---|---|---|---|

| Scott Gruber | Citigroup | Lowers | Purchase | $35.00 | $46.00 |

| Hamed Khorsand | BWS Monetary | Maintains | Purchase | $80.00 | $80.00 |

| Hamed Khorsand | BWS Monetary | Maintains | Purchase | $80.00 | $80.00 |

| Scott Gruber | Citigroup | Lowers | Purchase | $46.00 | $50.00 |

| Hamed Khorsand | BWS Monetary | Maintains | Purchase | $80.00 | $80.00 |

Key Insights:

- Motion Taken: Responding to altering market dynamics and firm efficiency, analysts replace their suggestions. Whether or not they ‘Keep’, ‘Elevate’, or ‘Decrease’ their stance, it signifies their response to latest developments associated to Seadrill. This provides perception into analysts’ views on the present state of the corporate.

- Score: Analyzing developments, analysts provide qualitative evaluations, starting from ‘Outperform’ to ‘Underperform’. These scores convey expectations for the relative efficiency of Seadrill in comparison with the broader market.

- Value Targets: Analysts present insights into value targets, providing estimates for the longer term worth of Seadrill’s inventory. This comparability reveals developments in analysts’ expectations over time.

Analyzing these analyst evaluations alongside related monetary metrics can present a complete view of Seadrill’s market place. Keep knowledgeable and make data-driven selections with the help of our Rankings Desk.

Keep updated on Seadrill analyst scores.

If you’re eager about following small-cap inventory information and efficiency you can begin by monitoring it right here.

Discovering Seadrill: A Nearer Look

Seadrill Ltd is an offshore drilling contractor firm. The corporate is engaged in offering offshore drilling companies to the oil and gasoline business. The first enterprise of the corporate is the possession and operation of drillships, semi-submersible rigs, and jack-up rigs for operations in shallow to ultra-deepwater areas in each benign and harsh environments. The geographical segments of the corporate are the USA, Brazil, Angola, Norway, Canada and others. The corporate derives most income from the USA.

Seadrill: A Monetary Overview

Market Capitalization Evaluation: The corporate reveals a decrease market capitalization profile, positioning itself under business averages. This implies a smaller scale relative to friends.

Income Challenges: Seadrill’s income development over 3 months confronted difficulties. As of 31 December, 2024, the corporate skilled a decline of roughly -29.17%. This means a lower in top-line earnings. As in comparison with its friends, the income development lags behind its business friends. The corporate achieved a development fee decrease than the common amongst friends in Power sector.

Internet Margin: The corporate’s web margin is a standout performer, exceeding business averages. With a formidable web margin of 34.95%, the corporate showcases sturdy profitability and efficient value management.

Return on Fairness (ROE): The corporate’s ROE is a standout performer, exceeding business averages. With a formidable ROE of 3.46%, the corporate showcases efficient utilization of fairness capital.

Return on Property (ROA): Seadrill’s ROA excels past business benchmarks, reaching 2.43%. This signifies environment friendly administration of property and powerful monetary well being.

Debt Administration: With a below-average debt-to-equity ratio of 0.21, Seadrill adopts a prudent monetary technique, indicating a balanced strategy to debt administration.

Analyst Rankings: What Are They?

Benzinga tracks 150 analyst companies and studies on their inventory expectations. Analysts sometimes arrive at their conclusions by predicting how a lot cash an organization will make sooner or later, normally the upcoming 5 years, and the way dangerous or predictable that firm’s income streams are.

Analysts attend firm convention calls and conferences, analysis firm monetary statements, and talk with insiders to publish their scores on shares. Analysts sometimes fee every inventory as soon as per quarter or at any time when the corporate has a significant replace.

Some analysts publish their predictions for metrics resembling development estimates, earnings, and income to offer extra steerage with their scores. When utilizing analyst scores, it is very important take into account that inventory and sector analysts are additionally human and are solely providing their opinions to buyers.

Which Shares Are Analysts Recommending Now?

Benzinga Edge offers you instantaneous entry to all main analyst upgrades, downgrades, and value targets. Kind by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.