Mutual funds have grow to be some of the in style funding choices for Indians, because of their potential for prime returns, skilled administration, and diversification advantages. Nonetheless, many traders, particularly learners, usually fall into frequent traps that may damage their returns and derail their monetary objectives.

On this weblog submit, we’ll dive deep into the 5 commonest mutual fund errors Indian traders make and supply actionable recommendations on easy methods to keep away from them. Whether or not you’re a seasoned investor or simply beginning out, this information will assist you to make smarter selections and maximize your returns.

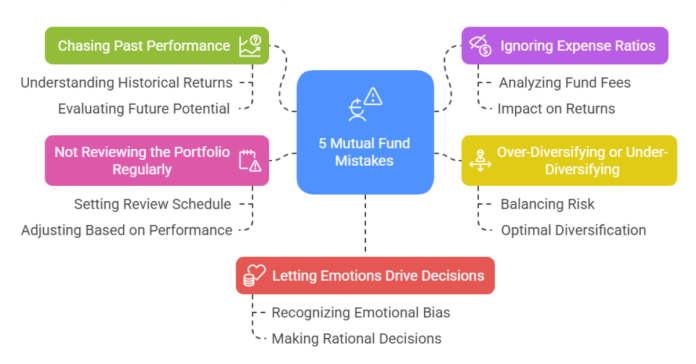

5 Mutual Fund Errors Each Indian Investor Makes (And The best way to Keep away from Them)

Mistake 1: Chasing Previous Efficiency

The Downside:

One of many greatest errors traders make is deciding on mutual funds primarily based solely on their previous efficiency. It’s tempting to have a look at a fund that delivered 30% returns final 12 months and assume it can do the identical this 12 months. Nonetheless, previous efficiency is just not a dependable indicator of future outcomes.

Why It Occurs:

- Buyers usually depend on “top-performing fund” lists printed by monetary web sites or advisors.

- The worry of lacking out (FOMO) drives them to put money into funds which are at present within the limelight.

The Actuality:

- Funds that carry out exceptionally effectively in a single 12 months usually underperform within the subsequent as a consequence of market cycles, adjustments in fund administration, or sector-specific dangers.

- Instance: Many sectoral funds (e.g., know-how or pharma funds) could ship stellar returns in a bull market however wrestle throughout a downturn.

The best way to Keep away from It:

- The easy technique is to undertake index funds. Regardless of how skilled the fund supervisor is, underperformance is an element and parcel of an energetic fund. Therefore, to keep away from the chance of fund managers, adopting the straightforward and low-cost index funds is healthier.

- Keep away from chasing “scorching” funds and as a substitute put money into diversified fairness or hybrid funds that align along with your danger tolerance and monetary objectives.

Mistake 2: Ignoring Expense Ratios

The Downside:

Many traders overlook the impression of expense ratios on their mutual fund returns. The expense ratio is the annual payment charged by the fund home for managing your cash, and it may possibly considerably eat into your returns over time.

Why It Occurs:

- Buyers usually focus solely on returns and ignore the prices related to investing.

- They might not totally perceive how even a small distinction in expense ratios can compound over the long run.

The Actuality:

- A fund with a 2% expense ratio will value you ? 20,000 yearly for each ? 10 lakh invested, whereas a fund with a 0.5% expense ratio will value solely ? 5,000.

- Over 20 years, this distinction can quantity to lakhs of rupees as a result of energy of compounding.

The best way to Keep away from It:

- At all times examine expense ratios earlier than investing in a fund.

- Go for direct plans as a substitute of normal plans, as they’ve decrease expense ratios.

- Think about low-cost index funds or ETFs, which usually have expense ratios beneath 0.5%.

Mistake 3: Over-Diversifying or Below-Diversifying

The Downside:

Diversification is essential to lowering danger in your portfolio, however many traders both overdo it or don’t do sufficient.

- Over-Diversification: Holding too many mutual funds can dilute your returns and make it tough to trace your portfolio.

- Below-Diversification: Placing all of your cash into one or two funds can expose you to pointless danger.

Why It Occurs:

- Buyers usually assume that including extra funds will mechanically scale back danger.

- Others could focus an excessive amount of on a single sector or theme, hoping to maximise returns.

The Actuality:

- Over-diversification can result in overlapping holdings, the place a number of funds put money into the identical shares.

- Below-diversification can lead to important losses if the chosen sector or fund underperforms.

The best way to Keep away from It:

- Goal for a balanced portfolio with 4-6 mutual funds throughout completely different classes (e.g., large-cap, mid-cap, debt funds).

- Keep away from overlapping funds by checking their portfolio holdings.

- Rebalance your portfolio periodically to take care of the suitable asset allocation.

Mistake 4: Not Reviewing the Portfolio Commonly

The Downside:

Many traders undertake a “set and overlook” strategy to mutual funds, assuming that their investments will develop on autopilot. Nonetheless, failing to overview your portfolio recurrently can result in suboptimal returns.

Why It Occurs:

- Buyers could lack the time or data to watch their investments.

- They might not understand that market circumstances, fund efficiency, or their very own monetary objectives can change over time.

The Actuality:

- A fund that was performing effectively 5 years in the past could now not be appropriate in your portfolio.

- Modifications in fund administration or technique can impression future returns.

The best way to Keep away from It:

- Conduct a portfolio overview not less than every year.

- Verify in case your funds are nonetheless aligned along with your monetary objectives and danger tolerance.

- Exit underperforming funds or people who now not suit your technique.

Mistake 5: Letting Feelings Drive Choices

The Downside:

Investing in mutual funds requires self-discipline and a long-term perspective. Nonetheless, many traders let feelings like worry and greed dictate their selections.

- Worry: Promoting off investments throughout market crashes or downturns.

- Greed: Chasing excessive returns or investing in dangerous funds with out correct analysis.

Why It Occurs:

- Market volatility can set off panic, particularly for inexperienced traders.

- The need for fast income can result in impulsive selections.

The Actuality:

- Promoting throughout a market crash locks in losses and prevents you from benefiting from the eventual restoration.

- Chasing excessive returns usually results in investing in unsuitable or high-risk funds.

The best way to Keep away from It:

- Stick with your monetary plan and keep away from making impulsive selections primarily based on market traits.

- Do not forget that mutual funds are a long-term funding, and short-term fluctuations are regular.

- Focus in your objectives and keep disciplined, even throughout market volatility.

The most effective methods to maximise your mutual fund returns is to start out investing early and contribute recurrently. Because of the ability of compounding, even small investments can develop into a major corpus over time.

Conclusion:

Investing in mutual funds is usually a rewarding expertise should you keep away from these frequent errors. By specializing in long-term objectives, holding prices low, and staying disciplined, you may construct a powerful portfolio that helps you obtain monetary freedom.

Bear in mind, the important thing to profitable investing is just not timing the market however time available in the market. So, take step one at present, keep away from these pitfalls, and watch your wealth develop!