As we step into the brand new 12 months, the enterprise panorama and the artwork of mergers and acquisitions (M&A) dealmaking continues to evolve, reflecting a dynamic mixture of challenges and alternatives.

A Pivotal 12 months Filled with Uncertainties and Alternatives

The 12 months 2025 is poised to be a pivotal 12 months for the M&A market, characterised by potential price cuts, adjustments in insurance policies, and record-high dry powder, all of which gas each uncertainties and alternatives. On this local weather, firms are anticipated to actively leverage M&A not merely to develop their market presence but additionally as a strategic device for adapting to the quickly evolving world financial setting. This underscores the significance of agility and foresight for corporations aiming to capitalise on the myriad of alternatives whereas skilfully navigating the related challenges. The confluence of those dynamic elements means that 2025 will witness not simply remoted mergers and acquisitions however a sequence of strategic transformations which have the potential to reshape complete industries.

Price Minimize on Standby

In 2024, the Federal Reserve executed three consecutive price cuts, amounting to a cumulative discount of 100 foundation factors, representing essentially the most substantial annual easing initiative since 2009. With the present price vary of 4.25 % to 4.50 %, the Fed anticipates a slower tempo of cuts in 2025 because of the persistently excessive inflation price in the US and the potential inflationary influence of President-elect Donald Trump’s proposed insurance policies.

Decrease rates of interest are prone to spur a rise in M&A actions by decreasing the price of financing and boosting inventory valuations, thereby narrowing the hole between patrons’ bids and sellers’ expectations. Whereas charges are nonetheless larger than in the beginning of the latest tightening cycle, the anticipated price reductions ought to assist facilitate dealmaking, albeit with out reaching the record-high exercise ranges seen in 2021.

Insurance policies Shuffle

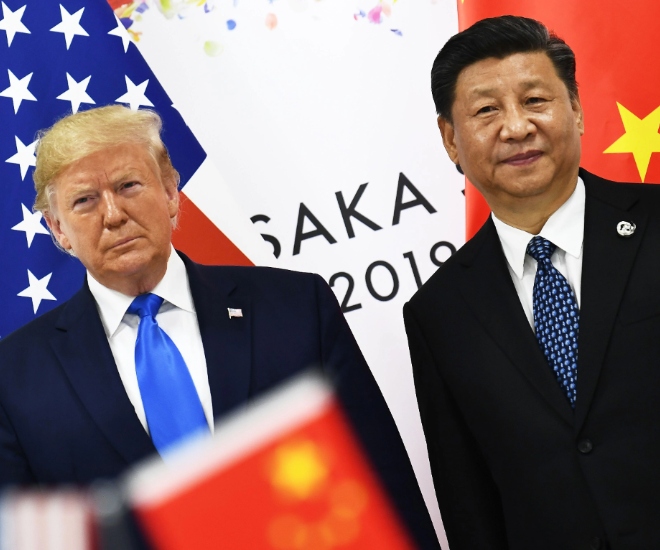

Because the world shifts its focus to the brand new president-elect, Donald Trump, and his proposed insurance policies, a ripple impact is anticipated by way of the financial system, essentially reshaping regulatory frameworks, fiscal insurance policies, and worldwide relations, all of which might considerably affect M&A actions.

One of many key areas of influence may stem from potential tariff will increase, together with a blanket tariff of 10 % to twenty % on imports from most international locations and a 60 % common tariff on items imported from China. This would possibly drive cross-border M&A actions and overseas direct investments as overseas firms search acquisition and overseas funding alternatives throughout the U.S. to determine “Made in America” manufacturing strains. Elevated tariffs on Chinese language imports and hostile insurance policies may additionally lead Chinese language firms to hunt acquisition targets in Europe or Southeast Asia.

In the meantime, industrialisation has emerged as a key development in Asia, considerably driving the worldwide financial system. As Asian firms develop and evolve, there may be an rising want for them to increase their operations or relocate to neighbouring international locations that supply bigger land areas, higher incentive insurance policies, and decrease labour prices. Consequently, there was a notable development of Chinese language firms establishing new factories and places of work in Southeast Asian international locations reminiscent of Vietnam, Thailand, and Indonesia. This strategic transfer not solely helps the businesses’ natural progress but additionally brings new financial alternatives to the rising markets within the area.

Report Dry Powder

Personal fairness corporations are at present sitting on an unprecedented quantity of uncalled capital, roughly USD 2 trillion, generally known as “dry powder”. This substantial money reserve has been accumulating because the final important world M&A surge in 2021. In the course of the previous three years, M&A exercise has seen a slowdown, with non-public fairness corporations shifting their focus to smaller transactions, reminiscent of company carve-outs. Nonetheless, as we transfer into 2025, the panorama is about to vary with heightened expectations. Many funds are starting to shed their cautious stance, and a substantial portion of this unallocated capital is anticipated to be deployed. Furthermore, funds are below rising stress from the Restricted Companions (LPs) to make investments as they strategy the midpoint of their fund life. This could probably result in a wave of considerable offers and acquisitions, which may redefine trade landscapes and drive important progress throughout varied sectors.

2025 Look Out

The 12 months 2025 will mark a interval of great transition, with companies navigating the evolving dynamics of a newly established administration whereas aiming to capitalise on rising alternatives. Corporations that may adapt swiftly to those adjustments are prone to acquire a aggressive edge, enabling them to execute strategic acquisitions and realise substantial progress. Because the political and financial panorama shifts, there shall be a necessity for agility and forward-thinking methods, permitting organizations to not solely face up to uncertainties but additionally thrive amidst them. These capable of preempt and reply to those adjustments shall be well-positioned to harness new market alternatives, solidifying their foothold and driving transformational progress within the months and years forward.

For extra on M&A developments and CIGP, go to: https://cigp.com/

This text was written by Managing Associate at CIGP Hugues de Saint Seine

Click on right here for extra on the most recent in enterprise and luxurious reads.