Dive Temporary:

- Monetary dangers are rising for universities that rely closely on federal funding for analysis, in keeping with a report launched Monday by S&P International Rankings.

- Establishments with the very best S&P credit score scores are additionally these more than likely to be damage by the Trump administration’s federal analysis cuts. Including to the pressure are different coverage modifications, corresponding to a proposed larger endowment tax and an immigration crackdown that might stem worldwide enrollment.

- “Materials cuts to federal analysis funds may create working pressures,” S&P analysts stated, pointing to particular establishments focused by the administration, together with Columbia and Harvard universities.

Dive Perception:

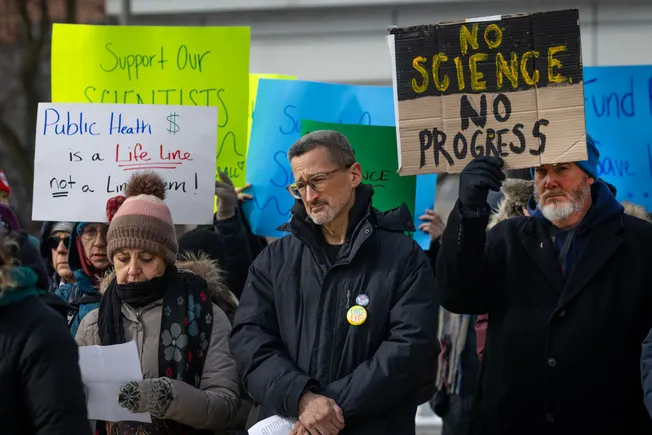

The Trump administration’s frenetic and infrequently chaotic cuts to analysis funding have already extensively disrupted operations at faculties.

Many establishments have resorted to layoffs in response to the Trump administration blocking cash for federally funded tasks. Johns Hopkins College, for instance, laid off some 2,200 staff tied to applications funded by the U.S. Company for Worldwide Growth after the administration dismantled the company.

Others have frozen hiring and budgets to take care of what monetary flexibility they’ll whereas they brace for federal cuts. In that group are Harvard and Columbia, who collectively have seen practically $3 billion in federal funds frozen as President Donald Trump seeks to stress them into making modifications to their lecturers and operations.

Broader funding disruption consists of makes an attempt to cap reimbursement for oblique analysis prices on the Nationwide Institutes of Well being and U.S. Division of Power. Whereas each strikes have been blocked by judges for now, they nonetheless go away analysis universities with deep uncertainty about the way forward for their federal grants and contracts.

Ought to the caps in the end turn out to be coverage, they’d deal a blow to analysis universities’ income and lift working stress on these establishments.

“Administration groups might want to assess funds choices to offset income loss, together with attainable expense cuts, layoffs, and lowered analysis programming,” S&P analysts stated in Monday’s report.

Analysts with Moody’s Rankings issued an analogous warning earlier this 12 months. The specter of analysis funding cuts, endowment tax hikes, interruptions to scholar help and slowing worldwide scholar enrollment led the credit score scores company to decrease its outlook to unfavorable for the upper ed sector for 2025.

However whereas universities may face monetary pressure, a lot of these most affected by Trump’s insurance policies have deep sufficient sources to climate disruption, at the very least within the brief time period, S&P analysts stated.

“We imagine the schools affected by these bulletins have ample reserves to supply flexibility ought to materials cuts transpire, particularly as they may very well be phased in over a number of years,” the analysts famous, pointing additionally to “robust fundamentals” corresponding to sound administration, liquidity and monetary flexibility — at these establishments.