Misplaced observe of your previous mutual fund investments? SEBI’s MITRA may also help you discover and reclaim them in minutes—right here’s how you can unlock hidden cash!

In February 2025, the Securities and Change Board of India (SEBI) launched the Mutual Fund Funding Tracing and Retrieval Assistant (MITRA), a digital platform designed to help buyers in finding and reclaiming inactive or unclaimed mutual fund investments.

What’s SEBI’s MITRA?

MITRA is a centralized, searchable database developed by SEBI in collaboration with Registrar and Switch Brokers (RTAs) like CAMS and KFin Applied sciences. The platform goals to assist buyers establish and recuperate mutual fund folios which have turn into inactive on account of numerous causes, comparable to outdated contact data or lack of know-how.

Why Was MITRA Launched?

Over time, many buyers lose observe of their mutual fund investments, particularly these made earlier than the implementation of obligatory PAN necessities in 2006. These investments usually stay unclaimed on account of:

- Modifications in touch particulars with out correct updates.

- Lack of understanding about investments made of their title.

- Non-compliance with present Know Your Buyer (KYC) norms.

MITRA addresses these points by offering a platform to hint and reclaim such investments.

Key Options of MITRA

- Centralized Database: MITRA consolidates knowledge from numerous AMCs, offering a single level of entry for buyers.

- Consumer-Pleasant Interface: The platform is designed to be intuitive, permitting customers to go looking utilizing primary particulars like PAN, title, or folio quantity.

- Safety Measures: MITRA incorporates strong cybersecurity protocols to guard investor data.

- Restricted Search Makes an attempt: To stop misuse, the platform permits as much as 25 search makes an attempt per consumer.

Who Can Use MITRA?

MITRA is meant for:?

- Particular person Traders: Seeking to hint their very own inactive or unclaimed mutual fund investments.

- Authorized Heirs/Nominees: Searching for to say investments of deceased family members.

- Monetary Advisors: Aiding purchasers in recovering forgotten investments.?

How one can Entry MITRA

Traders can entry MITRA by the next web site –

How one can Use the MITRA Portal: Step-by-Step Information

Right here’s an in depth walkthrough that will help you hint and reclaim your forgotten or inactive mutual fund investments utilizing MITRA:

Step 1: Go to the MITRA Platform

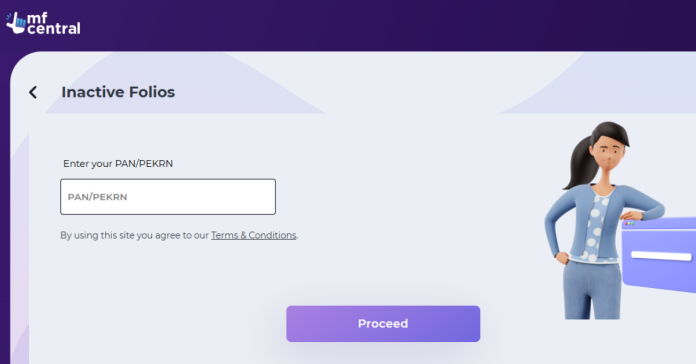

Go to any of the MF Central web site:

On the homepage, search for a banner or hyperlink titled “MITRA” or “Observe Your Outdated Mutual Fund Investments”. Click on on it to open the devoted MITRA portal.

Step 2: Enter Your Funding Particulars

You’ll now be prompted to fill in primary data. You may search by any a number of of the next:

- PAN Quantity (most correct methodology)

- Full Identify (as registered in funding)

- Date of Beginning

- Cellular quantity or Electronic mail ID (linked to the folio)

- Folio Quantity (if recognized)

Even for those who don’t keep in mind folio particulars, simply your PAN and title could also be sufficient to hint older information.

Step 3: Full the Verification

To make sure the privateness and safety of your knowledge, you’ll have to confirm your id utilizing OTP-based authentication:

- An OTP shall be despatched to your registered cellular quantity and/or e-mail.

- Enter the OTP on the platform to proceed additional.

In case your contact particulars are outdated or unlinked, the system will immediate you for alternate verification routes or updating KYC first.

Step 4: View Matched Outcomes

As soon as verified, the portal will:

- Scan throughout all AMCs (Asset Administration Firms)

- Present a listing of any unclaimed, inactive, or forgotten folios linked to your particulars

- Show the fund home title, folio quantity, scheme title, and holding worth (if any)

If nothing reveals up, strive utilizing different mixtures (like an previous cellular quantity, full authorized title, and so forth.)—you get as much as 25 search makes an attempt.

Step 5: Reclaim Your Mutual Fund Investments

If the platform finds matching folios, now you can start the method to retrieve them:

- Click on on the folio or fund you’d wish to reclaim

- Comply with the on-screen directions, which can embrace:

- Finishing or updating your KYC particulars

- Importing paperwork (like ID proof, cancelled cheque, and so forth.)

- Should you’re a nominee or authorized inheritor, submitting demise certificates or succession paperwork

As soon as submitted, the respective AMC or RTA (CAMS or KFin) will course of your declare. This may occasionally take a number of days to weeks relying on doc verification.

Significance of KYC Compliance

Making certain your KYC particulars are up-to-date is essential for:

- Facilitating clean transactions and redemptions.

- Receiving well timed updates and statements.

- Stopping fraudulent actions.?

MITRA encourages buyers to replace their KYC data to align with present norms.

Conclusion

MITRA serves as a useful software for buyers to reconnect with their forgotten or unclaimed mutual fund investments. By offering a centralized and safe platform, SEBI goals to boost transparency and investor safety within the mutual fund business. For extra data and to entry the MITRA platform, go to SEBI’s official web site.