6 analysts have expressed a wide range of opinions on Portillos PTLO over the previous quarter, providing a various set of opinions from bullish to bearish.

The next desk summarizes their latest rankings, shedding gentle on the altering sentiments throughout the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Scores | 2 | 0 | 4 | 0 | 0 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 0 | 0 | 0 | 0 | 0 |

| 2M In the past | 1 | 0 | 2 | 0 | 0 |

| 3M In the past | 1 | 0 | 1 | 0 | 0 |

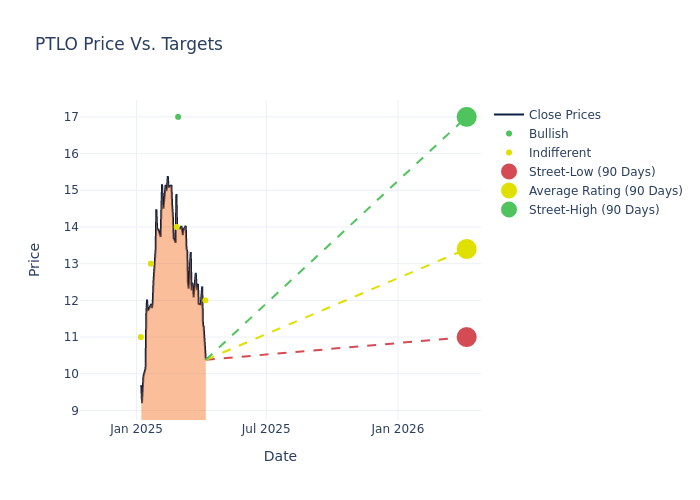

Analysts’ evaluations of 12-month value targets provide extra insights, showcasing a mean goal of $14.17, with a excessive estimate of $17.00 and a low estimate of $12.00. Staying fixed with the earlier common value goal, the present common stays unchanged.

Deciphering Analyst Scores: A Nearer Look

A transparent image of Portillos’s notion amongst monetary consultants is painted with a radical evaluation of latest analyst actions. The abstract under outlines key analysts, their latest evaluations, and changes to rankings and value targets.

| Analyst | Analyst Agency | Motion Taken | Ranking |Present Worth Goal| Prior Worth Goal |

|——————–|——————–|—————|—————|——————–|——————–|

|David Tarantino |Baird |Lowers |Impartial | $12.00|$15.00 |

|Chris O’Cull |Stifel |Raises |Purchase | $17.00|$16.00 |

|Jim Salera |Stephens & Co. |Raises |Equal-Weight | $14.00|$13.00 |

|Jim Salera |Stephens & Co. |Maintains |Equal-Weight | $13.00|$13.00 |

|Chris O’Cull |Stifel |Raises |Purchase | $16.00|$13.00 |

|Brian Harbour |Morgan Stanley |Lowers |Equal-Weight | $13.00|$15.00 |

Key Insights:

- Motion Taken: Analysts reply to modifications in market circumstances and firm efficiency, incessantly updating their suggestions. Whether or not they ‘Keep’, ‘Increase’ or ‘Decrease’ their stance, it displays their response to latest developments associated to Portillos. This info affords a snapshot of how analysts understand the present state of the corporate.

- Ranking: Analysts assign qualitative assessments to shares, starting from ‘Outperform’ to ‘Underperform’. These rankings convey the analysts’ expectations for the relative efficiency of Portillos in comparison with the broader market.

- Worth Targets: Analysts gauge the dynamics of value targets, offering estimates for the long run worth of Portillos’s inventory. This comparability reveals traits in analysts’ expectations over time.

Understanding these analyst evaluations alongside key monetary indicators can provide helpful insights into Portillos’s market standing. Keep knowledgeable and make well-considered choices with our Scores Desk.

Keep updated on Portillos analyst rankings.

In case you are all in favour of following small-cap inventory information and efficiency you can begin by monitoring it right here.

Delving into Portillos’s Background

Portillos Inc serves the Chicago road meals business by high-energy and multichannel eating places designed to ignite the senses and create memorable eating experiences. It owns and operates fast-casual eating places in the USA, together with two meals manufacturing commissaries in Illinois. Its menu contains scorching canines, beef and sausage sandwiches, sandwiches and ribs, salads, burgers, hen, Barnelli’s pasta, sides and soup, and desserts and shakes.

Monetary Milestones: Portillos’s Journey

Market Capitalization Evaluation: Falling under business benchmarks, the corporate’s market capitalization displays a diminished dimension in comparison with friends. This positioning could also be influenced by components akin to progress expectations or operational capability.

Decline in Income: Over the 3M interval, Portillos confronted challenges, leading to a decline of roughly -1.73% in income progress as of 31 December, 2024. This signifies a discount within the firm’s top-line earnings. Compared to its business friends, the corporate trails behind with a progress fee decrease than the common amongst friends within the Client Discretionary sector.

Web Margin: Portillos’s monetary energy is mirrored in its distinctive internet margin, which exceeds business averages. With a outstanding internet margin of 6.1%, the corporate showcases robust profitability and efficient price administration.

Return on Fairness (ROE): The corporate’s ROE is under business benchmarks, signaling potential difficulties in effectively utilizing fairness capital. With an ROE of 2.88%, the corporate may have to deal with challenges in producing passable returns for shareholders.

Return on Belongings (ROA): Portillos’s ROA lags behind business averages, suggesting challenges in maximizing returns from its property. With an ROA of 0.76%, the corporate might face hurdles in reaching optimum monetary efficiency.

Debt Administration: With a below-average debt-to-equity ratio of 1.49, Portillos adopts a prudent monetary technique, indicating a balanced strategy to debt administration.

The Fundamentals of Analyst Scores

Analysts work in banking and monetary techniques and sometimes focus on reporting for shares or outlined sectors. Analysts might attend firm convention calls and conferences, analysis firm monetary statements, and talk with insiders to publish “analyst rankings” for shares. Analysts sometimes fee every inventory as soon as per quarter.

Some analysts additionally provide predictions for useful metrics akin to earnings, income, and progress estimates to offer additional steering as to what to do with sure tickers. It is very important take into account that whereas inventory and sector analysts are specialists, they’re additionally human and might solely forecast their beliefs to merchants.

Which Shares Are Analysts Recommending Now?

Benzinga Edge provides you immediate entry to all main analyst upgrades, downgrades, and value targets. Kind by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.