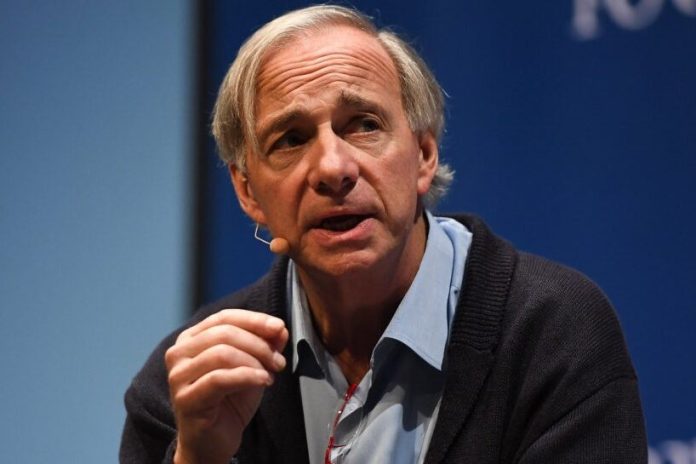

Esteemed investor Ray Dalio as soon as in contrast timing the market to competing within the Olympics, suggesting that the previous is a fair larger problem.

What Occurred: Talking in a podcast in 2022, Dalio shared his insights and cautioned towards trying to forecast inventory traits, arguing that almost all people should not adequately ready for such a job.

Dalio additionally recognized a typical error amongst buyers: assuming that markets which have risen are good investments, slightly than merely being extra expensive.

“Do not attempt to time the market your self since you’ll most likely lose. The commonest mistake of buyers is to suppose that the markets that went up are good investments slightly than dearer,” he mentioned.

He supplied an instance of a high-performing fund the place the common investor misplaced cash as a result of makes an attempt to time the market.

“Each time it was up they purchased it, and each time it was down they offered it. So their unhealthy market timing was as a result of they had been reactive, considering it is an amazing funding when it is up so much,” Dalio added.

Additionally Learn: Ray Dalio’s ‘Holy Grail’ Funding Technique: Why 10-15 Diversified Investments Might Make You a Fortune

His recommendation aligns with that of funding guru Warren Buffett, who said in 1994 that he by no means tries to time the market. As an alternative, Dalio recommends contemplating low-cost index funds and holding onto them.

One of these diversified fund sometimes stays comparatively steady, avoiding the fluctuations related to deciding on particular person shares.

Why It Issues: Ray Dalio’s recommendation comes at a time when many buyers are grappling with market volatility and uncertainty.

His comparability of market timing to the Olympics underscores the problem and danger concerned in such makes an attempt.

His endorsement of low-cost index funds as a safer different might affect investor methods transferring ahead, significantly amongst those that have been burned by unsuccessful makes an attempt to time the market.

Learn Subsequent

Picture: Shutterstock

This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Market Information and Information dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.