Tesla Inc. TSLA has reportedly encountered a $1.4 billion hole between its capital expenditure and the valuation of associated property over the past six months of 2024.

What Occurred: This discrepancy, highlighted in a report by Monetary Instances, comes as Tesla’s inventory market valuation has plummeted from $1.7 trillion to beneath $800 billion.

Based on the report, Tesla’s money movement assertion reveals $6.3 billion spent on property and tools purchases within the third and fourth quarters of 2024. Nevertheless, the stability sheet exhibits solely a $4.9 billion enhance within the gross worth of property, plant, and tools throughout the identical interval.

Tesla didn’t instantly reply to Benzinga’s request for remark.

See Additionally: Elon Musk’s Tesla Focused With Arson Assaults In Las Vegas, Kansas Metropolis: Report

Regardless of Tesla’s substantial money reserves of $37 billion, the corporate raised $6 billion in new debt final yr.

This raises questions on Tesla’s monetary methods, particularly because it plans to speculate closely in AI infrastructure, robots, computing, and batteries, with at the least $11 billion earmarked for every of the approaching years.

Monetary consultants, together with Jacek Welc from SRH Berlin College, counsel that such monetary anomalies may point out weak inside controls or aggressive expense classification.

Tesla’s ongoing capital elevating, regardless of important money movement, is seen as a possible purple flag for accounting misstatements.

Why It Issues: The monetary discrepancy at Tesla comes amid a turbulent interval for Elon Musk, the corporate’s CEO. Musk has been juggling his obligations between Tesla and his position within the Division of Authorities Effectivity (DOGE) beneath the Trump administration.

In a current interview, Musk admitted to dealing with important challenges in managing his companies, coinciding with a pointy decline in Tesla’s inventory.

Buyers have expressed frustration over Musk’s divided focus, with some, like Tesla’s largest bull, voicing issues about his consideration being diverted from the corporate. Dan Ives from Wedbush Securities has additionally highlighted the unsustainable nature of Musk’s present management scenario for Tesla’s shareholders.

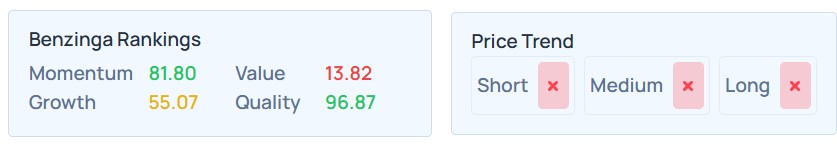

Tesla holds a momentum ranking of 81.80% and a progress ranking of 55.07%, in response to Benzinga’s Proprietary Edge Rankings. The Benzinga Progress metric evaluates a inventory’s historic earnings and income growth throughout a number of timeframes, prioritizing each long-term traits and up to date efficiency. For an in-depth report on extra shares and insights into progress alternatives, signal up for Benzinga Edge.

Take a look at extra of Benzinga’s Future Of Mobility protection by following this hyperlink.

Learn Subsequent:

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and printed by Benzinga editors.

Picture courtesy: Shutterstock

Momentum81.80

Progress55.07

High quality96.87

Worth13.82

Market Information and Knowledge dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.