“How a lot can I safely withdraw from my portfolio?” is a incessantly requested query amongst pre-retirees and new retirees. Ben Felix stated it was 2.7%. Morningstar stated it was 4.0%. Invoice Bengen stated it was 4.7%. Dave Ramsey stated it was 8%. The upper the secure withdrawal price, the extra retirees can spend from their funding portfolios.

Researchers developed strategies to boost the secure withdrawal price. Some prompt utilizing a guardrail system. Some prompt utilizing annuities, entire life insurance coverage, or a reverse mortgage. In any case, the implied message is that it’s fascinating to have the next withdrawal price.

You additionally hear that it’s a problem for brand new retirees to modify from saving to spending. Some monetary advisors say a giant a part of their function is to encourage purchasers to spend more cash. I additionally know YouTube and podcast exhibits that scold individuals for not dwelling a wealthy life. A well-liked e book Die With Zero encourages individuals to spend more cash once they’re nonetheless younger.

Little question some individuals need to spend extra however irrationally concern that doing so will jeopardize their future. Strategies for overcoming this irrational concern embrace shopping for annuities, constructing a TIPS ladder, setting apart cash in a separate “enjoyable cash” account, and creating spending targets and color-coded monitoring programs to offer oneself “permission to spend.”

Nevertheless, I might say this emphasis on withdrawals and spending in retirement is misplaced. What issues in retirement is enjoyment and life satisfaction. Spending is a poor proxy for enjoyment and life satisfaction. One of the best issues in life are (practically) free. It’s OK to not spend more cash once you go for enjoyment and life satisfaction.

Spending Requires Time and Consideration

Spending at all times entails selections, which require time and a focus to kind via. Retirees don’t want one other job in determining the best way to spend their cash. They might desire to direct their time and a focus elsewhere.

My spouse and I spent a number of hundred thousand {dollars} on all kinds of supplies and labor after we constructed our home final yr. We’re pleased with the ultimate outcomes however the means of spending all that cash took plenty of time and psychological power.

Ought to we use this 10″ x 2.5″ blue rectangular tile or this 4″ x 4″ white sq. tile for our kitchen backsplash?

We need to paint the inside partitions white. Does that imply White Dove, White Heron, Cloud White, or every other 50 shades of white?

We now have onerous water right here. Do we would like a water softener that makes use of salt pellets or a saltless water filtration and conditioning system?

Some individuals would possibly say the issue was as a result of we purchased issues and it might be higher to spend cash on experiences. Setting apart whether or not dwelling in a home through which all the pieces was hand-picked by ourselves is an expertise, spending on experiences additionally requires selections, time, and a focus.

Did you say worldwide journey? The place to go? When? For a way lengthy? Want visa? Which airline to make use of? Purchase the tickets now or wait? Economic system, Premium Economic system, or Enterprise Class? Use money or factors? The place to remain? What to see? Join a tour or go on our personal?

Low Perceived Worth

Observers of retirees not spending as a lot as they’ll afford mistakenly assume these retirees have to be afraid of operating out of cash. Moreover not eager to waste their valuable time and power on spending, retirees aren’t spending as a lot as a result of they don’t see worth in extra spending.

After we have been constructing our home, I noticed some neighbors put in these uncovered beams on their ceilings:

I misplaced curiosity once I discovered they have been three-sided empty packing containers purely for adornment.

Another neighbors selected Wolf, Sub-Zero, and Thermador kitchen home equipment. I’m certain these high-end home equipment have some options regular home equipment don’t have. I wasn’t all in favour of discovering out what these options have been as a result of mainstream home equipment had at all times labored nicely for me.

A house within the neighborhood was marketed as a furnished rental. It stated all their furnishings got here from RH. Once I talked about this to my spouse, she requested “What’s RH?“

I’m driving a 2005 Honda Accord. It’s been with me for 20 years. I understand how it really works. It takes me wherever I need to go. I can afford a brand new automotive however a brand new automotive would nonetheless take me to the identical locations. I don’t see why I ought to spend time determining whether or not I ought to need an EV, a hybrid, or a gas-powered automotive, which model, mannequin, trim, and choices, or whether or not they’re nonetheless charging hundreds over MSRP with a protracted wait to get a brand new automotive.

I’m not depriving myself of ornamental fake beams, high-end home equipment, upscale residence furnishings, or a brand new automotive once I’m pleased with what I’ve now. Getting out of my strategy to get them can be a distraction.

Spending Is a Poor Proxy for Enjoyment

I spent a full month in Switzerland in the summertime of 2022. I loved it and wrote a weblog publish about it. The journey value over $10,000 all-in.

A neighbor gave away a 20-year-old low cost bike by the curb final yr. Walmart sells a brand new bike a lot better than this for underneath $200 at present.

I pumped some air into the tires and it nonetheless labored. I hadn’t ridden a motorbike since faculty. I began driving it within the neighborhood, on the town, and finally on a gravel street by a lake, which gave me this view within the spring:

Using a motorbike obtained me to locations I hadn’t been. I rode this outdated low cost bike over 60 instances in a yr.

Trying again, I can actually say that a budget bike gave me extra pleasure than the $10,000 trip in Switzerland. I loved each but it surely doesn’t imply that costly worldwide journey (expertise!) have to be extra pleasing than an affordable bike (issues!).

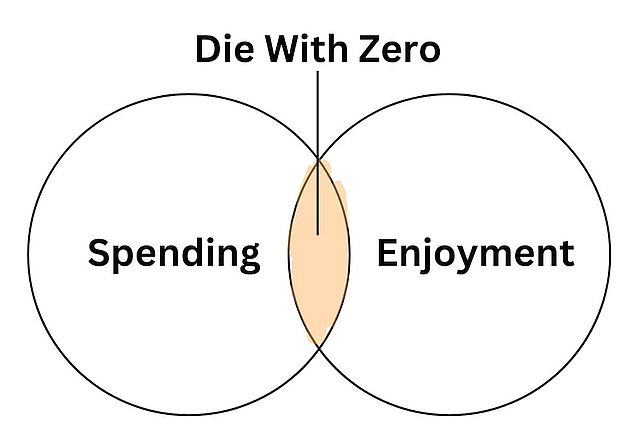

And that’s my largest drawback with the e book Die With Zero. It falsely equates spending with enjoyment as if the extra you spend the extra you’ll get pleasure from life. Cash not spent is seen as forgone enjoyment. Spending can induce or improve some enjoyment however there’s solely a skinny overlap between the 2. Fixating on spending misses the true supply of enjoyment.

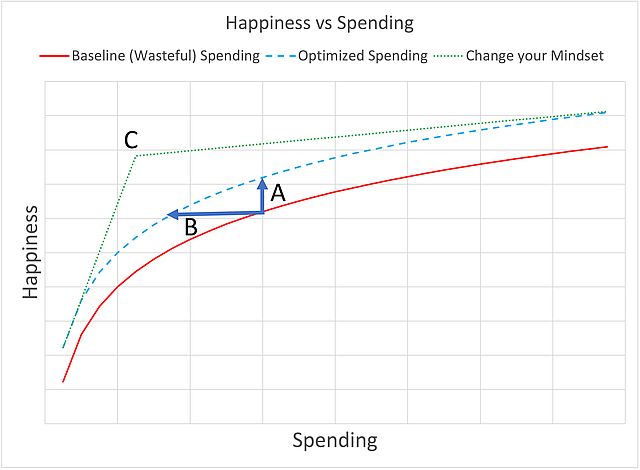

The blogger Frugal Professor included this chart in his weblog publish The Spending Tradeoff — Alternative Prices vs Utility. The inexperienced dotted line exhibits the connection between spending and happiness when you have got a special mindset.

He concluded that when you shift your mindset, you unlock a superpower through which your happiness is basically uncorrelated together with your spending when you hit a modest level C. Or as reader Eloise stated within the feedback:

Happiness is basically an “inside” job. It’s within the mindset. Having the time to mirror on this and uncover it, is priceless.

The Greatest Issues in Life Are Free

A bonus of retirement is having extra free time. I can’t imagine the infinite pleasing actions that value little to no cash.

I do newbie yoga by following movies by Yoga With Adriene on YouTube. It’s free.

I do some body weight workouts — pushups, squats, plank, lunges, and fowl canine. You want at most a $20 train mat.

I take a e book to learn on my favourite park bench underneath a tree by a pond. It’s free.

I discovered historical past once I watched a 6-hour documentary sequence The U.S. and the Holocaust by Ken Burns. It’s free on Kanopy via the general public library. Kanopy additionally has The Criterion Assortment movies and academic programs by The Biggest Programs.

I stroll up a hill once I’m not driving a motorbike. It’s free and it’s good for each bodily and psychological well being. This was the view final week (our house is down there within the center):

We had booked journey to the Dolomites area of Italy this summer time.

Because the dates drew nearer, we requested why we needed to be vacationers in Italy after we have been having fun with our actions regionally. Our house is extra snug than a lodge. The meals we cook dinner is more healthy than restaurant meals. We don’t must take care of potential flight delays, crowds, theft, or getting sick.

So we canceled the journey (expertise!) and used the cash to purchase two new bicycles (issues!). We had a lot enjoyable studying mountain biking as newbies. Each trip put a giant smile on our faces. I rode 19 instances for a complete of 28 hours since I purchased the bike on the finish of August. I’m within the again on this compiled video:

I agree with Christine Benz when she stated this on X:

“Reminiscence dividends” don’t solely come from a once-in-a-lifetime expertise similar to flying 50 buddies to an island, renting out a whole lodge, and reserving your favourite band for a non-public efficiency (this was an instance within the e book Die With Zero). In addition they come from extra frequent easy joys that value practically nothing.

OK to Underspend

A wealthy life isn’t about spending cash. One of the best issues in life are free. You gained’t fear a lot in regards to the secure withdrawal price when you search for enjoyment and life satisfaction in the best locations. It isn’t a personality flaw when you’re not spending as a lot as you may afford.

I like this reply to the query Why is figuring out a withdrawal price or methodology so troublesome? on the Bogleheads Discussion board:

For many of us right here, the one strategy to make this troublesome is an effort to attempt to spend as a lot as you probably can with out operating out.

We’re not making an attempt to try this, so it’s not troublesome for us.

It’s not troublesome for us both. We concentrate on having fun with the very best issues in life no matter whether or not it requires spending cash. If it does, we spend the cash (we paid $6,000 for our two bicycles). In any other case we don’t concern ourselves with whether or not we’re “underspending.”

What do you do when the cash pile grows and grows?

Giving, whether or not to household or charities, is totally completely different from spending. Cash given to younger individuals and charities means lots to them. Seeing the outcomes of your assist brings again enjoyment and life satisfaction. Search for methods to offer to household and charities. Give early and provides usually.

Say No To Administration Charges

If you’re paying an advisor a share of your property, you might be paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.