Join Chalkbeat Indiana’s free each day publication to maintain up with Indianapolis Public Faculties, Marion County’s township districts, and statewide training information.

Indiana Home lawmakers on Thursday authorized their model of the following state finances, sending the proposal to the Senate to contemplate form training funding for the following two years.

The Home draft is just like the proposal first outlined by Republican Gov. Mike Braun earlier this yr, together with an roughly 2% annual enhance in tuition assist, which funds each public colleges and personal college vouchers.

However lawmakers have additionally restored funding that may have been reduce to gifted and gifted training and folded curriculum prices into the bottom funding that colleges obtain.

The finances handed over the objections of Home Democrats, who referred to as for common eligibility for preschool vouchers, in addition to extra funding for conventional public colleges.

However the Republican architects of the finances rejected their amendments, saying that they fund college students, not colleges.

“Public colleges would get a number of cash subsequent yr if mother and father selected to ship them there,” mentioned Rep. Jeffrey Thompson, writer of the finances invoice and chair of the Home Committee on Methods and Means.

The Senate will now take into account the finances. Senators have already handed property tax measures that may doubtless decrease the property tax income out there to varsities, although not as a lot as an preliminary proposal by Braun. These tax measures will now transfer to the Home for consideration.

Right here is the place training funding stands on the midpoint of the legislative session.

Training finances adjustments textbook funding distribution

Republican lawmakers are nonetheless proposing an roughly 2% enhance in tuition assist annually of the finances, or round $180 million extra in 2026 and $370 million extra in 2027. This determine is according to Braun’s proposed enhance for tuition assist.

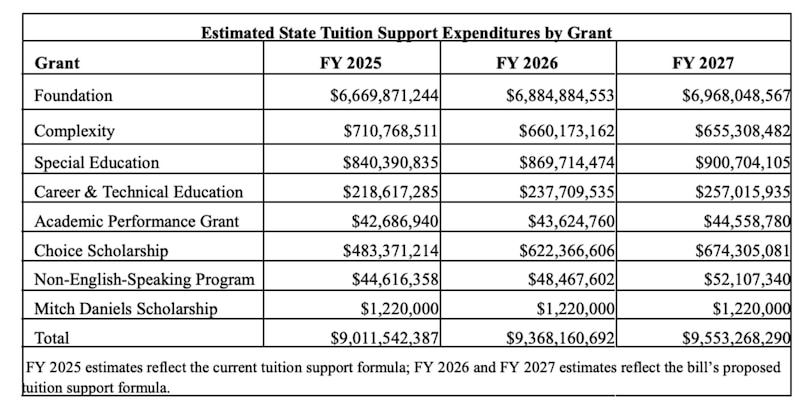

However the whole budgeted for tuition assist within the new draft of the finances appears increased as a result of lawmakers want to roll the funding that colleges obtain for textbooks into the foundational quantity colleges obtain for educating college students. Thus the full finances for tuition assist is $9.4 billion for 2025-26 and $9.6 billion in 2026-27.

Faculties obtained $160 million for curriculum prices in 2025.

“By placing it within the basis that’s going to develop as we develop the muse all through the years,” Thompson mentioned.

This fund will even cowl a proposal to make college vouchers common for all households, no matter earnings, which might price the state round $89 million in 2026 and $95 million in 2027, based on an estimate from the Legislative Companies Company, or LSA. In whole, the Selection Scholarship program is anticipated to price round $622 million in 2026 and $674 million in 2027.

The graph beneath from LSA reveals a breakdown of tuition assist expenditures. Basis quantities are the bottom funding that colleges obtain to teach all college students, whereas complexity {dollars} go to college students from low-income backgrounds.

Below the brand new finances proposal, the tutoring assist will even fund digital college students at 100% of the foundational quantity, quite than 85% as is at present legislation.

In different training funding, lawmakers have proposed $86 million per yr for the Freedom and Alternative in Training fund, up from $25 million per yr within the first draft of the finances. This fund is a brand new line merchandise supposed to offer the state Division of Training flexibility to fund priorities, corresponding to increasing the brand new ILEARN checkpoint check, working the state educating jobs board, and funding pupil studying restoration grants.

Moreover, Gifted and Gifted Training funding has been restored to $15 million per yr after going through a reduce to $13 million per yr within the first draft of the finances. The second draft additionally provides funding to the finances earmarked for grownup learners.

Nevertheless, Republican lawmakers didn’t restore funding for the Dolly Parton Creativeness Library regardless of calls from their Democratic colleagues to take action.

They’ve additionally stored summer time college funding flat at round $18 million, although one other invoice will permit the Division of Training to differentiate funding for these applications primarily based on the sort and size of the course.

Lastly, lawmakers are rising the annual allocation for Training Scholarship and Profession Scholarship accounts — two voucher-like applications used to pay for college kids with disabilities to obtain providers exterior of faculties and for top schoolers to take profession coaching with non-public corporations.

Each applications will every obtain $15 million per yr — lower than the $25 million initially proposed for Training Scholarship Accounts, however greater than the $11 million first proposed for Profession Scholarship Accounts.

Revised property tax aid invoice nonetheless impacts college funding

Indiana Senators, in the meantime, have handed a property tax aid invoice that mitigates the preliminary influence of Braun’s proposal to cap property taxes. That proposal was anticipated to price colleges and different native authorities entities round $1.2 billion in 2026 and as much as $1.6 billion in 2028.

The revised Senate Invoice 1 is now anticipated to price these entities round $300 million in 2026 and $800 million in 2028. (Braun has prompt he would take into account vetoing the invoice if it doesn’t present extra aid to taxpayers.)

It could additionally produce other results on funding as a result of it restricts the years that colleges can maintain referendums to basic elections as an alternative of each basic and first elections.

Based on a revised report from the Workplace of Fiscal and Administration Evaluation, Senate Invoice 1 would scale back funding to Indianapolis Public Faculties by an estimated $1.2 million in 2026 and as much as $2.9 million in 2028.

Different districts in Marion County are projected to lose:

- Beech Grove Metropolis Faculties — $139,000 in 2026 as much as $364,000 in 2028.

- Franklin Township Faculties — $241,000 in 2026 as much as $443,000 in 2028

- MSD of Decatur Township — $37,000 in 2026 as much as $68,000 in 2028

- MSD of Lawrence Township — $33,000 in 2026 and $740 in 2028

- MSD of Perry Township — $60,000 in 2026 as much as $492,000 in 2028

- MSD of Pike Township — $566,000 in 2026 as much as $1.4 million in 2028.

- MSD of Warren Township — $338,000 in 2026 as much as $759,000 in 2028

- MSD of Washington Township — $1.2 million in 2026 as much as $3.1 million in 2028

- MSD of Wayne Township — $780,000 in 2026 as much as $2 million in 2028

- Faculty City of Speedway — $71,000 in 2026 as much as $166,000 in 2028

Senate Invoice 1 has handed the Senate and can now transfer to the Home for consideration.

One other invoice, Senate Invoice 518, additionally handed a last vote within the Senate Thursday. It requires districts to share some property tax income with constitution colleges. Property tax income funds colleges on prime of the state tuition assist described above, and at present, solely districts in a handful of counties should share a few of this income with constitution colleges.

An modification Wednesday delayed a few of the sharing provisions till 2028.

However the Republican supermajority voted down a number of amendments by Senate Democrats that may have as an alternative despatched the difficulty to a summer time research committee, required audits of constitution colleges receiving property tax income, or lowered the quantity that constitution colleges obtain.

Aleksandra Appleton covers Indiana training coverage and writes about Okay-12 colleges throughout the state. Contact her at [email protected].