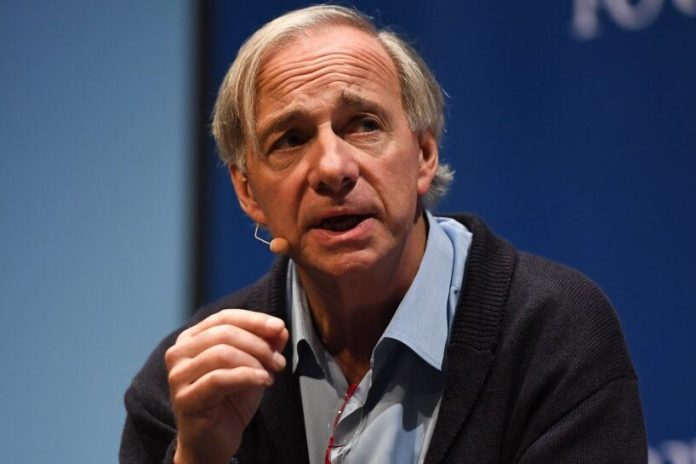

Following the current feedback from billionaire investor Ray Dalio on “costly,” firms with excessive valuations, his fund Bridgewater Associates trimmed its positions in six of the ‘Magnificent 7’ shares throughout the fourth quarter, whereas taking a contemporary place in Elon Musk-led Tesla Inc. TSLA.

What Occurred: In line with its 13-F submitting with the U.S. Securities And Alternate Fee, the ‘Magnificent 7’ shares witnessed a double-digit minimize of their positions at Bridgewater, besides Tesla.

- Reducing about 40% of its current holdings, Apple Inc.‘s AAPL worth in Bridgewater’s portfolio stood on the lowest among the many ‘Magnificent 7’ shares at $154.559 million, as of Dec. 31, 2024.

- Bridgewater held essentially the most Class A Alphabet Inc. GOOGL shares within the stated quarter among the many ‘Magnificent 7,’ trimming simply 17% of its place from the third quarter, valued at $685.513 million.

- Positions in Nvidia Corp. NVDA, Meta Platforms Inc. META, Microsoft Corp. MSFT, and Amazon.com Inc. AMZN had been additionally slashed in double digits from the third to the fourth quarter.

- Nonetheless, Dalio’s fund added 153,589 shares of Tesla to its portfolio for the primary time in three years after the fourth quarter of 2021. It was valued at $62.025 million.

| Firm | Holdings (as of Sept. 30) | Holdings (as of Dec. 31) | Change (in %) | Worth As Of Dec. 31 |

| Alphabet Inc. GOOGL | 4,379,337 | 3,621,308 | -17% | $685.513 million |

| Nvidia Corp. NVDA | 4,754,271 | 3,497,362 | -26% | $469.660 million |

| Meta Platforms Inc. META | 802,202 | 621,088 | -23% | $363.653 million |

| Microsoft Corp. MSFT | 870,178 | 667,036 | -23% | $281.155 million |

| Amazon.com Inc. AMZN | 1,411,643 | 919,786 | -35% | $211.684 million |

| Apple Inc. AAPL | 1,031,856 | 617,203 | -40% | $154.559 million |

| Tesla Inc. TSLA | 0 | 153,589 | 0% | $62.025 million |

See Additionally: Billionaire Ray Dalio Raises Valuation Issues As DeepSeek’s New Mannequin Hits Nvidia Inventory

Why It Issues: Dalio, in a dialogue with David Friedberg on the All-In Podcast, cautioned in opposition to solely specializing in “good” firms, following the tech inventory rout after the recognition of Chinese language AI agency DeepSeek.

“An important firm that will get costly is far worse than a foul firm that is actually low-cost,” he warned. Dalio urged traders to prioritize worth and contemplate pricing dynamics, particularly within the present financial local weather.

He expressed issues in regards to the “superscalars” like Nvidia, highlighting their potential dangers. As a substitute, Dalio suggested traders to prioritize productiveness, innovation, and disruptive applied sciences, whereas fastidiously contemplating pricing and world financial developments. He emphasised investing in these growing and using purposes that drive optimistic change.

Regardless of the modifications to ‘Magnificent 7’ shares, exchange-traded funds took the best place within the worth phrases in Bridgewater’s portfolio. The fund held $4.824 billion and $1.2 billion in ETFs monitoring the S&P 500 index and $922.163 million within the ETF monitoring the MSCI Rising Markets index.

| ETFs | Holdings (as of Sept. 30) | Holdings (as of Dec. 31) | Change (in %) | Worth As Of Dec. 31 |

| SPDR S&P 500 ETF Belief SPY | 836,965 | 8,232,049 | 884% | $4.824 billion |

| iShares Core S&P 500 ETF IVV | 2,222,834 | 2,039,343 | -8% | $1.2 billion |

| iShares Core MSCI Rising Markets ETF IEMG | 17,779,378 | 17,659,209 | -1% | $922.163 million |

Learn Subsequent:

Photograph courtesy: Shutterstock

Market Information and Information dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.